2023 Year-end Review and Outlook for 2024: Are Market Expectations Overly Optimistic?

2023 was a strong year in the equity markets. As we closed the year, market participants became increasingly confident that a “soft landing” (continued economic growth despite tightening monetary policy) was likely, and that the Federal Reserve would begin to cut interest rates beginning as early as March 2025.

While we all celebrate strong market returns, it’s important to remember the wild ride we’ve been on in the financial markets since the Covid-19 pandemic so that we understand the current environment and risks. Monetary policy has been the most important driver of investor sentiment and market performance since the market crash in March 2020 (and it can be argued, back to the Great Financial Crisis in 2008).

As we look to 2024 and beyond, the key question for this year is whether market expectations are overly optimistic. Continued economic growth and a series of market-supportive rate cuts in 2025 would be a best-case outcome for the financial markets. However, risks remain heightened. Will 2024 bring us continued strength in the markets, or will we see a weakening consumer and more persistent inflation, shifting sentiment to the negative?

While the 2020 outbreak and global shutdown is now years ago, some of the impacts of the pandemic and the response to the pandemic still linger. Remember that after the initial outbreak and major market decline in March 2020, the Federal Reserve flooded the markets with liquidity and emergency monetary support. Congress and the White House followed with massive fiscal stimulus programs to aid U.S. individuals and corporations. This intervention worked and resulted in a swift market recovery. The S&P 500 closed up 16% in 2020, despite the initial decline.

In 2021, the recovery accelerated. Boosted by the substantial amount of government support and near zero interest rate environment, the “free money” conditions drove an even stronger year in the equity markets. The S&P 500 closed 2021 up +27%. However, in 2022, inflation surged to 40-year highs. The Fed, caught off-guard, raised the Fed Funds rate rapidly in a panicked attempt to get inflation under control. The Fed’s unprecedented tightening measures and the heightened concern that they would result in an economic recession, drove a material decline in the financial markets in 2022. The S&P 500 closed down -20%. The bond market saw unprecedented losses, with the Bloomberg U.S. Aggregate Bond Index down -15% for the year.

2023: Expectations for a Soft Landing and Interest Rate Cuts in 2024 Drives Major Rally

Coming into 2023, concerns were elevated. Market participants worried about a major economic growth slowdown and persistent inflation. A soft landing, wherein the Fed tightens monetary conditions without causing an economic recession, is rare. In early spring, we observed the first victims of the Fed’s tightening measures: Silicon Valley Bank and several other banks abruptly failed after experiencing bank runs. The government again intervened to support the financial system, and again the markets were off to the races.

The second half of 2023 had a relatively lackluster start, with the Fed hiking rates for the 11th time in July to a target range of 5.25-5.5%. However, as the year progressed further, market participants became increasingly more confident that the Fed would pause its rate hikes by the end of the year, and then would begin to cut rates throughout 2024. While a soft landing was highly improbable, the economy, and particularly the consumer, has remained resilient throughout the year. With a slightly slowing but still strong labor market and inflation decelerating rapidly, a soft landing is now the market’s base case assumption for 2024, with three to four potential rate cuts expected throughout 2025.

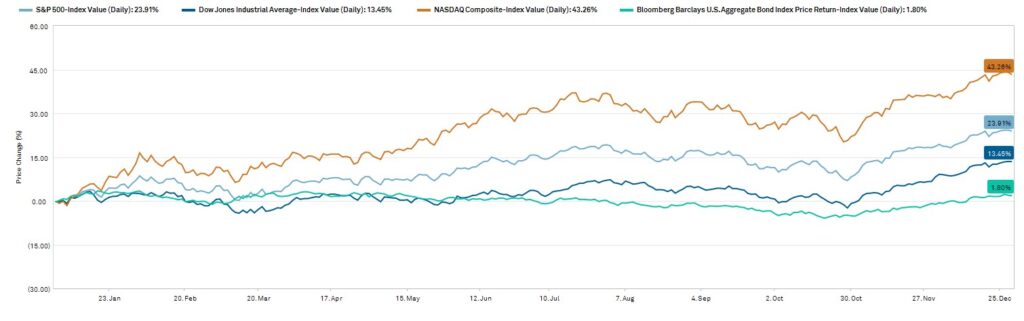

The S&P 500 was up +24% in 2023. The tech-heavy Nasdaq returned +43%. Even the stodgy, more-mature Dow Jones Industrial Average returned +13%. The bond market avoided losses, posting returns of ~2%. Of note, investors were rewarded for putting their funds to work in cash instruments, including short-term money market funds and bank CDs, which could earn investors 5-7% with limited risk.

Narrow Market in 2023 Led By “Magnificent 7”

In 2023 note that the performance of the S&P 500 was driven primarily by a small group of stocks. In 2023, the “Magnificent Seven” (an updated list of the FAANG stocks from recent years), which includes Apple, Alphabet (Google), Amazon, Meta, Tesla and Nvidia saw massive returns after the introduction of ChatGPT drove investor exuberance around the prospect of artificial intelligence fueling stock returns. Nvidia was up nearly +240% in 2023, Meta +194% and Tesla +100%. The S&P 500 is a market-weighted index, meaning that larger companies which have outsized performance have a greater impact on the overall index. If the index were equal-weighted, where each company’s investment returns were treated equally, the index would have been up 12%.

2024 Outlook: Normalization or Long-delayed Recession?

The key issues for the markets in 2024 and beyond are economic growth, the future path of inflation and the future path of interest rates. Many hope that 2024 will be a year of normalization, during which the Fed will end its significant support of the financial markets and “normal” fundamental factors such as revenues and profit margins will propel equities and government and corporate yields will not be distorted by government influence.

Risks Continue to Be Heightened for 2024: Overly rosy market expectations can often create higher risk of selloffs when sentiment changes. I have worried in previous blogs and letters that we may be in a Wile E. Coyote moment, where we’ve run off the cliff but haven’t fallen yet. It does look like there is a chance that a soft landing does occur, which would be an incredible outcome. However, market participants today may also be overconfident, creating a risky backdrop for investment returns. Broad consensus is for 3-4 rate cuts in 2024. If inflation remains higher than expected, the Fed will likely pause at its current rate level and keep short-term rates high, which would likely cause market volatility. Many have forgotten that the Fed misread the inflationary trends in the first place and had to react with major force. The Fed is not omniscient or infallible, and a recession may still result from its delayed reaction, albeit with a lagged effect. Longer-term U.S. Treasury interest rates, which underpin much of the economy’s borrowing costs, have increased, and are also working to slow the economy. Cracks in credit, including commercial real estate, have not caused major issues yet but still may.

The consumer, relying on savings built up during the pandemic and supported by strong labor, financial and housing markets, has been propping up economic growth. Will those coffers begin to run empty in 2024? Will employment growth slow or weaken? This would help inflation but would slow the economy meaningfully if consumers pull back on spending. As well, analysts expect a strong year of earnings, with targets for 11-12% profit growth, according to Factset[1]. This may be too optimistic. Geopolitics remain unstable, with a new theater of conflict in Gaza. And last, but not least, are the uncertainty elections in the U.S. will cause throughout the year. Many recession indicators continue to flash yellow or red. We are not out of the woods yet, and high levels of volatility are the new normal.

As well, narrow markets can be unstable. The “Magnificent 7” are strong companies (many near-monopolies) with high profit margins. Not all of them have the growth profile to justify their market capitalizations. Also, while valuations, or the prices we pay for stocks, do not appear to be drastically high, they are higher than normal.

Now is a time to tread carefully but to also take advantage of some new opportunities in the market. With cash yields high, it’s possible to take limited risk while receiving an attractive return. As well, bond yields are finally moving into more attractive territory, and we are hopefully back to an investment environment wherein fixed income can be relied on to provide a cushion in investor portfolios.

Best wishes for 2024.

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.