Q2 2024 Market Update: Favorable Backdrop Continues, But Markets on a Highwire

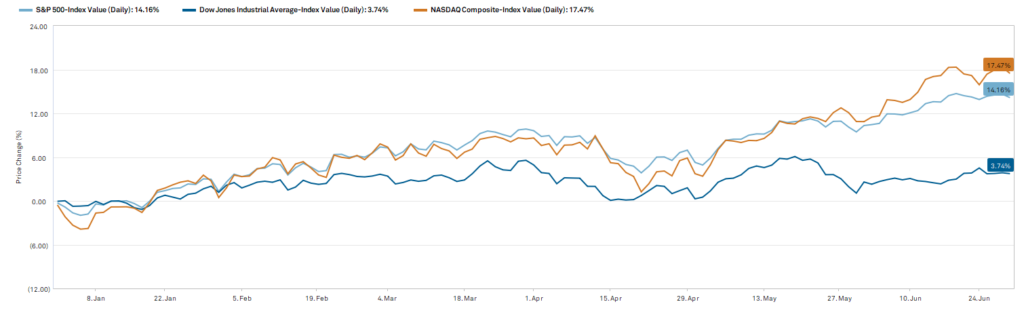

After a bumpy start in April, most U.S. equity indexes continued to climb in the second quarter of 2024. The main themes driving stocks higher remain the same throughout the first half of the year: investor exuberance around the potential for artificial intelligence, solid company earnings reports, slowing but steady economic growth and the potential for at least one interest rate cut later this year.

Artificial Intelligence Exuberance Driving Equity Market Returns

The artificial intelligence stock rally continued in the second quarter, accompanied by increasing investor nervousness about the development of a bubble. The stocks currently surging on the AI excitement are key players in generative AI and suppliers to the new market. We’re in an early stage of broad deployment of AI, and companies are rushing to build out the infrastructure for this technology.

The next phase could be even more promising, as AI has the potential to boost productivity across the economy broadly. In many of the early winners, valuations have increased quickly, raising the risk around these stocks. Many of these companies generate substantial profits and free cash flow and have dominant market positions. The key question to ask is: are market expectations outpacing reality, increasing the risk that the stocks could face a major correction?

Also note that this surge in AI stocks has created what’s called a “concentrated” market. In other words, just a few companies are driving the strong investment returns this year, particularly in the S&P 500 Index, and large tech companies dominate the index. If the index were equally-weighted, returns would have been just 5%[1].

Underlying Corporate Earnings Remain Strong, Expectations are For Acceleration

According to Factset Insight, earnings growth expectations for 2024 are 11% and for 14% in 2025 – a substantial acceleration vs 2023’s +1% growth expectations[2]. This would mark an acceleration from already strong earnings growth of 6%[3] in Q1 2024 and expectations of ~8% in Q2 2024. However, this earnings strength assumes the benefits of a rate cut or cuts, and earnings are expected to be strong despite a slowing economy. This is a tricky balance, and again, like AI stocks, lofty valuations create increased risk.

All Eyes Remain on the Fed and Interest Rates

A major driver of financial markets has continued to be the “macro” environment and on the Federal Reserve’s (“Fed”) monetary policy. As we began 2024, investors expected up to seven cuts to short-term interest rates over the course of the year, which provided a substantial tailwind to the equity markets. However, as inflation proved persistent, the Fed kept the Federal Funds rate steady. Guidance from the Fed is now for only one rate cut by year-end. Rate cuts are stimulative for the financial markets and economy. Currently it appears that we may be headed for a real ‘soft landing’, wherein a tightening monetary policy does not result in a recession and a meaningful increase in unemployment, an incredible best-case outcome.

While attention has been focused on short-term interest rates, medium and long-term interest rates have been increasingly volatile this quarter, in part as concern has intensified over US debt levels. As the debt position of the US increases, the relative risk of a US bond rises, and investors demand higher interest rates to buy our securities. Bond prices move inversely to interest rates, so as rates rise bond prices decline. U.S. Treasuries in particular were volatile this quarter. Rising rates, or “yields” on 10-year US Treasury bonds have repercussions throughout the economy, as many securities, such as mortgage securities and corporate debt, are “benchmarked” off the 10-year US Treasury. Should yields rise in a more permanent way, economic and financial activity could slow.

Outlook

A potential market-boosting rate cut or cuts, strong corporate earnings and a resilient economy create a positive backdrop. However, there is still a wide range of outcomes for the rest of 2024, and risk has risen as valuations have increased, the market has become even more concentrated and expectations have become increasingly positive. Note that the lead-up to the US elections in November will be noisier than expected. Typically, while elections can create fear and generate strong emotions, what impacts companies and financial markets is an actual change in policy and regulation well after the President is in place. As always, a long-term view and a balanced, diversified portfolio of high-quality securities remain the keys to long-term investing success.

[1] https://www.nasdaq.com/articles/first-half-2024-review-and-outlook

[2] https://insight.factset.com/analysts-project-sp-500-to-report-double-digit-earnings-growth-for-2024-and-2025

[3] https://insight.factset.com/earnings-insight-infographic-q1-2024-by-the-numbers

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.