This Bull Market Has Been Easy to Spook – What to Watch for This Fall

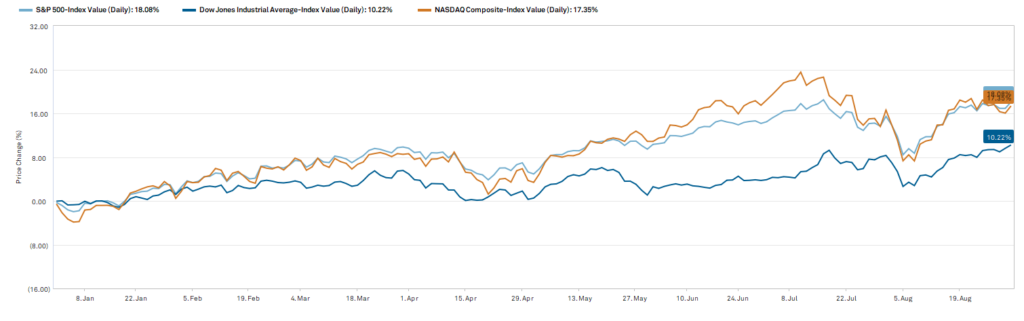

Despite a big pullback at the end of July and early August, the equity markets have been on a tear in 2024. The S&P 500 Index, which tracks 500 leading U.S.-traded companies, is up over 18% through the end of August, outpacing the tech-heavy Nasdaq Composite Index, which is up +17%. Even the more sober Dow Jones Industrials Index, comprised of more mature companies, is up over 10% through August 31st.

Despite the strength, the markets have had some rapid, severe declines. Like an easy-to-spook horse, this bull market is nervous.

The sell-off in early August (typically a month when most traders are at the beach) was prompted by the convergence of three seemingly unrelated events. First, large investors had borrowed at Japan’s very low interest rates and invested at higher interest rates elsewhere. Unexpectedly, the Japanese central bank raised rates, right as the U.S. Federal Reserve Bank (the “Fed”) and other developed countries discussed cutting rates, resulting in a squeeze and a rush to unwind positions as quickly as possible. This precipitated a rapid decline in the Japanese markets which carried over to the rest of the world’s markets. At nearly the same time, Warren Buffett materially reduced Berkshire Hathaway’s large position in Bank of America stock, causing investors to wonder what risks Buffett was seeing that they were not. To add to the fear, the markets worried that the labor markets were weaker than originally thought. Positive market sentiment vanished quickly, but recovered as we moved further through the month.

This market is likely to continue to be touchy as we move into the fall. U.S. elections will increase investors’ overall anxiety. The key issues to watch over the next few months are the Fed’s interest rate policy and corporate earnings trends. The U.S. elections will create jitters, and the clamor will escalate as we get closer to November. Volatility is likely to remain high.

Debate Has Shifted to How Big Rate Cuts Will Be (and How Soon We’ll Get Them)

The one key driver of market sentiment continues to be the future short-term interest rates, specifically the “Federal Funds Rate”, which the Fed raises and lowers to guide monetary policy*.

The debate in 2024 among investors has been when a rate cut is coming and how large it will be. The Fed has a dual mandate: price stability and maximum employment. The Fed’s focus through mid-2024 was controlling inflation, which appears to be slowing. However, weak data points have raised concerns that the labor market (higher rates tend to hurt the labor market as the economy slows and companies reduce their workforces) is weakening too rapidly. Over the past several weeks, the Fed has highlighted its new focus on the labor market, and market participants currently expect the Fed to begin cutting rates at its September meeting to ease the pressure on the labor markets. What remains unclear is the size of this rate cut, and size and timing of future rate cuts.

In general, lower short-term rates create a tailwind for the market and are stimulative for the economy overall. Market participants are pulling for a larger cut and the subsequent boost to the markets. Note that this is unlikely before elections, as the Fed does not want to appear to politicize monetary policy, but throughout the year and into early 2025 rate cuts will likely continue.

*For context, remember that after the Covid-19 crisis, the Fed added massive amounts of liquidity to the markets, in part by lowering Fed Funds rates to zero in order to stimulate economic activity and assist the financial markets’ recovery. At the same time, Congress added substantial fiscal support. While the monetary and fiscal support worked, and we avoided a major recession, but a consequence of adding so much extra liquidity to the markets was a spike in inflation. To get inflation under control, Fed raised the Fed Funds rate at an unprecedented pace, raising rates by nearly five percentage points over 16 months.

Strong Company Earnings – A Key Support to the Markets

Corporate earnings remain strong. In Q2 2024, the year-over-year growth rate for the S&P 500 is 11.3%, the highest growth rate since Q4 2021[1]. While analysts are reducing estimates slightly for the third quarter, expected year-on-year growth is 4.9% and fourth quarter growth is 15.4%. For the full year, earnings growth is expected at a strong 10.1%.[2]

Despite the positive backdrop, reaction to earnings results has been punitive. Nvidia, one of the most closely watched stocks in the market as it is a beneficiary of AI-related spending, beat estimates substantially but still traded down as its ‘beat’ fell short of sky-high investor expectations. Dollar General, highly anticipated because of its ‘read-through’ on lower-end consumers, posted disappointing results and traded down over 30% [3]. Sentiment has been mercurial, with extreme reactions to disappointments. Companies are hanging in there, but investor expectations are extended, and poor results are being severely punished. These types of markets are brutal, but can create real opportunities.

US Elections Will Create Jitters, As Always

After a sleepy start to election season, when the general assumption was that President Biden would face off against former President Trump, everything got thrown in the blender as Biden stepped aside and Vice President Harris became the Democratic Presidential nominee with just a few months to go. This appears to have both reenergized and confused the race overall. The time for policy formulation, discussion and debate has been compressed materially. There has been some discussion on trade and tariffs, tax policy, and antitrust approaches, but the specific impact of new Harris or Trump policy, which matters the most to companies and individuals, is still largely unknown.

Elections create fear, as emotions come into play with political viewpoints. As we move closer and closer to November 5th, the doom-and-gloom news cycle will worsen. While often difficult, the best approach with election season is to remain objective and to make no major changes to investment portfolios.

Volatility Will Continue

Over the next several months in particular, we will likely have continued pockets of extreme volatility. Anomalous market events or trade unwinds could happen again as the interest rate regime in major markets change. As well, there are persistent concerns that the Fed has waited too long to cut rates, and some data points have created confusion about how well the economy is actually doing. This type of spookiness will continue.

Overall, particularly in this type of nervous market with major events coming up, it’s a good idea not to make drastic changes to your portfolio. A former mentor of mine had a sign on his wall that said: “Don’t just do something – sit there!” This is the opposite of what we want to do, as action creates the feeling that we are helping things, but keeping calm and staying the course is critical to success, particularly in these volatile times.

[1] Factset Earnings Insight, September 6, 2024

[2] Ibid.

[3] https://www.wsj.com/business/retail/dollar-general-scales-back-guidance-after-quarterly-results-fall-short-of-target-18f5ab47

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.