Hold On! 2024 Year-end Review and What to Watch in 2025

Happy New Year! Each January brings the National Western Stock Show to Denver, and in one of the annual events, Mutton Bustin’, brave kids hang on to sprinting sheep for as long as possible. Investors will likely need to hold on tight as well this year.

2024 was a strong year in the equity markets, and many of the key themes from the past year, including the outlook for interest rates, strength of corporate profits, and the continuing evolution of artificial intelligence, will continue to drive markets in 2025. We will have additional volatility this year, as President-elect Trump is inaugurated in January and his administration and Republican Congress begin work quickly on key legislative initiatives. One of the most important bills to watch is the renegotiation and extension of the Tax Cuts and Jobs Act of 2017, which sunsets at the end of this year. New legislation will potentially impact individual and corporate tax rates, deductions, estate tax exemptions and U.S. debt levels, among other things.

2024 Year in Review

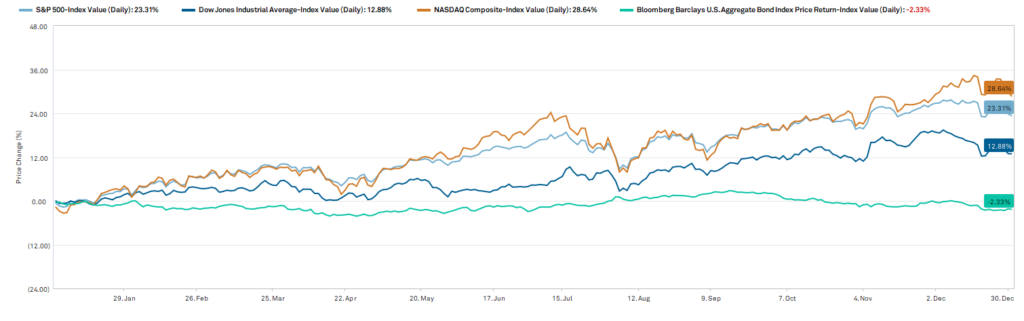

2024 posted another year of blockbuster gains in the equity markets, and the markets hit record highs. Recall that in 2023, two years ago, the S&P 500 Index was up +24%, the tech-heavy NASDAQ Index returned 43%, and the more mature Dow Jones Industrial Average Index was up 13%. In 2024, this past year, the markets continued to post record gains. The S&P Index was up +23%, the NASDAQ up +29%, and the DJIA was up 13%. These are blowout returns and are much stronger than ‘normal’ equity returns, which typically range from 5-8% per year.

A key driver for the strength in the equity markets was increased confidence that the Federal Reserve Bank (the “Fed”) would begin to cut interest rates as inflation came back under control and labor markets remained strong. Recession concerns evaporated as economic growth remained positive and a “soft landing” (monetary policy tightening without causing a recession) became a reality. In addition, continued investor exuberance around the potential for artificial intelligence (“AI”) drove continued strength in large-cap growth stocks. Consumer sentiment remained positive, and consumer spending, helped by wealth effects from the housing and financial markets, remained strong.

In contrast, the bond markets remained lackluster. The Bloomberg Barclays Aggregate posted losses, down over -2% in 2024. In 2023 the index returned just under 2%. Interest rate variability remained high over the course of the year, driven by changing economic outlooks, uncertainty over Fed rate action and the rising U.S. deficit. The yield on the 10-year U.S. Treasury note increased from 3.88% to 4.58%. The bond market will become an increasingly important market to watch in 2025.

2025: Fireworks Likely – Key Market Themes to Continue

2024’s themes will continue into 2025. Interest rates will continue to dominate discussions, with the added nuance that both short-term (the rates the Fed influences) and medium to long-term (10-year and 30-year U.S. Treasuries) rates will be in focus. In addition, when President-elect Trump takes office late January, he will look to tackle major legislation, including tax and immigration policy. As well, all eyes will remain on growth in corporate profitability, with particular focus on companies with exposure to artificial intelligence.

In addition to the “short” end of the interest rate curve the Fed influences, the “long” end of the U.S. Treasury market (10 and 30-year bonds) will be key to watch. While the equity markets reacted positively to President Trump’s election in November as hopes for deregulation, tax cuts and more market-friendly policy increased, the more sober bond market had a different reaction. The 10-year yield increased, reflecting heightened concerns as the potential for an increase in U.S. government debt rose. Higher debt levels mean increased risk for investors who own our debt, and they demand more yield, or interest, to own it to compensate for the added risk. Should these longer-term rates remain elevated or increase, there is higher risk for a slowdown in the overall economic environment in the U.S.

The first half of 2025 will likely be volatile, as actual policy and legislation will be introduced, negotiated, and potentially passed. An extension of the Tax Cuts and Jobs Act of 2017, which lowered tax rates and increased estate tax exemptions, will likely be a top priority and be tackled first. On the ground in Washington, the new President has a Republican Congress, but quite a narrow majority in the House and a short time frame to get new bills passed and signed. 2025 is a key year, as the 2017 tax legislation expires at year-end, and as we move closer to mid-term elections political winds may start to shift. Fireworks are likely, particularly the first half of the year.

The “Magnificent 7” stocks, including Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta and Tesla saw continued strong earnings growth, driven by an artificial intelligence ‘arms race’ as major companies raced to build data centers and artificial intelligence models. Since these companies are driving stock returns, it’s reasonable to wonder how long it will last – the duration of their earnings is key. As they go, the market goes, at least in the near future.

Risks are Elevated – Remain Cautious

There is a high level of uncertainty around interest rates, new legislation and policy and its impact on the economy, financial markets and national debt. As well, the sustainability of earnings growth as we move into 2025 and beyond is unclear.

Financial markets have hit all-time highs and valuations are extended versus historical levels. Sentiment is positive and potentially overconfident. The fixed income markets are increasingly on edge. Returns are likely to be a bit more muted going forward, with a real probability of high volatility and corrections. Parts of the market are frothy. Bitcoin has surged, investing has begun to converge with gambling. More and more capital is flowing to private, unregulated, higher risk corners of the financial markets.

Now is a time to tread carefully while taking advantage of market opportunities and secular growth trends. Diversification remains foundational, with portfolios comprised of companies with strong and stable free cash flow characteristics, high returns on capital and lower-risk balance sheets. Bond investments remain under close watch, given the market volatility.

Best wishes for 2025.

Lariat Wealth Management is a registered investment adviser offering advisory services in the State of Colorado and other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Past performance is no guarantee of future results. The information herein was obtained from various sources. Lariat Wealth Management does not guarantee the accuracy or completeness of such information provided by third parties. The information given is as of the date indicated and believed to be reliable. Lariat Wealth Management assumes no obligation to update this information, or to advise on further developments relating to it.