Tax day is Tuesday, April 15, 2025.

A few reminders as we get closer to the deadline:

April 15th, 2025, Deadlines:

- Traditional IRA Contributions: 2024 contributions to a traditional IRA can be made through April 15, 2025. Contributions are typically tax deductible and can be up to $7,000 for those under age 50 and $8,000 for those 50 and older.

- HSA Contributions: Tax filers who have a high-deductible health care plan can make tax deductible contributions to an HSA for tax year 2024 through April 15, 2025. Individuals can contribute $4,150 and families can contribute $8,300. Those 55 and older can contribute an additional $1,000.

Getting organized for filing 2024 Taxes[1]:

- Refer to your prior year’s return to note what was needed last year and ensure that you capture any changes in the 2024 tax year.

- The primary categories of materials for tax season include:

- Income documentation:

- W2 income from employment / paycheck stubs

- 1099s or other records of Social Security income, dividends & interest, capital gains, business income, rental income and some retirement income[2]

- Clients: please note that Form 1099s and tax documents are available from Fidelity. You should have received an email from Fidelity with a link to the documents, or alternatively please navigate to the Fidelity website or browser, hit the “Accounts and Trade” button, and scroll down and click “Tax Forms and Information”. You’ll be able to download the tax forms you need to provide to your CPA.

- Deduction & credit documentation:

- Many taxpayers take the standard deduction, however records for deductible expenses, including childcare, home mortgage/property tax/sale records, donations to charity and donor-advised funds, HSAs & healthcare expenses, retirement contributions, and education expenses, are important to retain and provide to your CPA

- Credits reduce the amount of tax owed, and can include credits for clean vehicle and home energy purchases, higher education credits and parent/caretaker credits

- Note Roth IRA contributions are not deductible

- Income documentation:

- Submit your materials well in advance of the tax deadline so that you can review them thoroughly with your CPA.

Reminders for 2025:

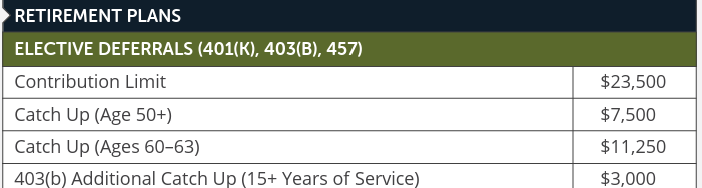

- Adjust workplace plan contributions for 2025. New contribution limits for 2025 are $23,500, with a $7,500 catch-up for employees over 50, and an addition bonus catch-up of $11,250 for employees between ages 60-63. This bonus catch-up is new in 2025.

Adjust HSA contributions for 2025 if necessary. 2025 contribution limits are $4,300 for self-only coverage and $8,550 for family coverage. Those 55 and older can contribute an additional $1,000.

IRA contribution limits remain the same as 2024’s limits, and are $7,000 and $8,000 for those 50 and older

Future potential changes to be aware of:

Gift and Estate Tax Exemption – Expanded Exemption Set to Expire at the end of 2025: the exemption for gift and estate tax was expanded meaningfully in 2017. The exemption for 2025 is $13,990,000 per individual and $27,980,000 per married couple. The bonus exemption will sunset and revert back to ~$7mm per person January 1, 2026, unless it legislation is passed this year to extend the exemption.

Use of any information presented is for general information only and does not represent individualized tax advice, either express or implied. You are encouraged to seek professional tax advice for questions and assistance.

Lariat Wealth Management is a registered investment adviser offering advisory services in the State of Colorado and other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Past performance is no guarantee of future results. The information herein was obtained from various sources. Lariat Wealth Management does not guarantee the accuracy or completeness of such information provided by third parties. The information given is as of the date indicated and believed to be reliable. Lariat Wealth Management assumes no obligation to update this information, or to advise on further developments relating to it.

[1] https://www.irs.gov/filing/gather-your-documents

[2] https://www.irs.gov/e-file-providers/definition-of-adjusted-gross-income