That’s All Folks: Warren Buffett to Exit as Berkshire Hathaway’s CEO

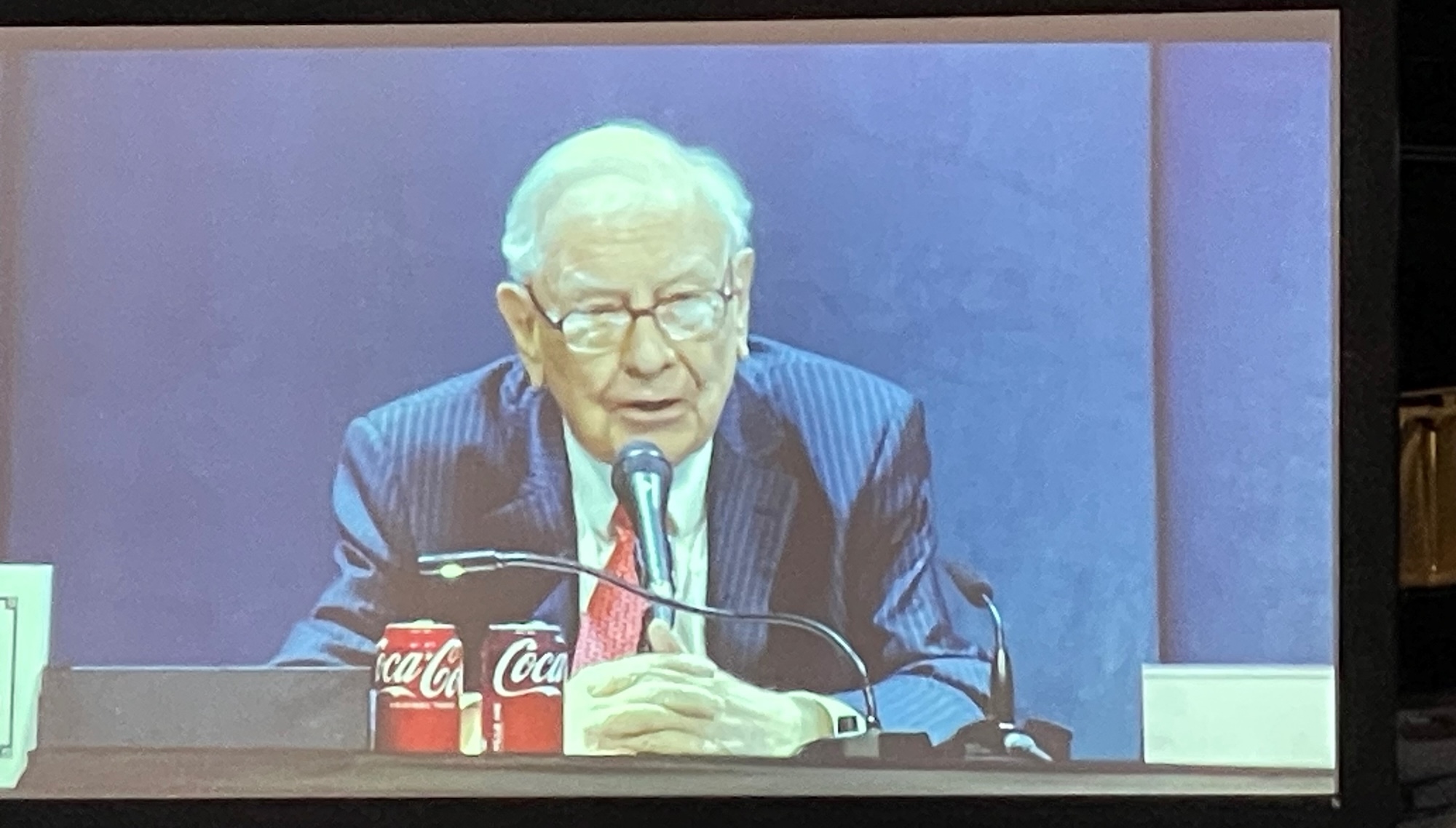

Each year thousands of investors make the annual pilgrimage to Omaha to attend Berkshire Hathaway’s annual meeting. The meeting itself is a fun and festive event, with a huge hall next to the arena showcasing Berkshire Hathaway’s companies, including See’s Candies, BNSF Railroad, Justin Boots, Dairy Queen, Brooks Running, Netjets and Geico, to name just a few. The meeting has attracted so many people for so long because Warren Buffett, the “Oracle of Omaha”, and at earlier meetings his long-time friend and Berkshire Hathaway vice-chairman Charlie Munger, spend hours answering questions and sharing wisdom on life, investing and current events. There are always key takeaways, which I’ll share below, however this year there was special news. Warren Buffett announced that he would step down as CEO, ushering in a new era for the company.

Buffett Announces Departure: The biggest news of the meeting happened in the last five minutes: Warren Buffett announced that he would step down as CEO of Berkshire Hathaway at the end of 2025. Greg Abel, long-time leader of Berkshire Hathaway Energy and head of Berkshire’s non-insurance operations, will take over at that point. Although a transition was anticipated, especially after Munger’s death at the end of 2023, it was still an emotional moment. Buffett received a long standing ovation from the crowd.

Key takeaways from the 2025 Berkshire Hathaway Shareholder meeting:

Current events:

- This year’s stock market turbulence is not a correction or crisis. “What has happened in the last 30, 45 days… is really nothing”. Buffett noted that Berkshire Hathway stock has been down -50% three times over the course of his career, even though the value of the business did not change that much. But be ready: he warned that there will be a period in the next 20 years that will be a financial “haircurler”.

- Deficits and foreign currency/US dollar devaluation came up repeatedly. Politicians must “resist the urge to debase currency”. Note that Buffett has had strong opinions on runaway trade deficits for decades – see the attached reading from 2003 – and though he doesn’t like the idea of import certificates anymore he does think balanced trade is important, and trade deficits are directly related to a nation’s bond issuance and currency.

On investments:

- Read: “It’s amazing what you find when you turn a page”. Buffett read a book listing the publicly traded Japanese companies and ended up making investments in 5 top Japanese trading houses at bargain prices. This has been a constant theme in Berkshire meetings – Charlie would joke that his family thought he was a book with two legs sticking out of it.

- Business models change: For example, Ajit Jain’s Berkshire’s head of insurance, noted that Geico’s auto insurance is evolving from insurance against operating error risk to product liability risk, as self-driving cars become more and more pervasive. Businesses and competitive landscapes change and evolve.

- “Check emotions at the door when you invest”. If you are rattled when stocks go down -15%, adjust investment philosophy. Big corrections can offer big opportunities.

- Focus on risk: Buffett prioritizes his analysis of a company’s balance sheet over its income statement, as it’s harder to hide problems on a balance sheet. Also suggested: make a strong case against your investment before you buy it, so you understand the pros and cons of the investment extremely well.

On life:

- America is truly exceptional: “enjoy your luck” because you were born in a great time in history

- Who you associate with is very important

- If you can, do what you would do if you didn’t need the money

Berkshire: What’s Next? Greg Abel, the incoming CEO, will not get the “Oracle of Omaha” free pass, even if Buffett will stay on as Chairman. Questions will arise immediately on how he will use Berkshire’s massive cash pile (total cash is over $325bn and fun fact: BRK owns 5% of the US Treasury market). Investors will wonder if Abel will effectively allocate capital, including whether he will institute a dividend, buy back more shares and/or acquire new businesses. His answer during the meeting was a bit unclear. Abel is a more active manager than Buffett, and the sheer scope of his job is daunting. Investors and investment bankers will be interested in whether there will be divestitures, spin-offs or other types of optimization of the massive conglomerate. And it’s not clear if the Nebraska insurance regulators will be as understanding on the large equity holdings in National Indemnity in the future. The biggest question is what happens when Buffett passes away and his ownership stake of Berkshire (approximately 14% and valued at over $150bn) will move to Trusts controlled by his three children. In the meantime, he has committed to “not selling a share”. This incredible success story – which included some notable failures! – will move on to its next phase.

It’s been lucky to work and invest in this Buffett and Munger era, and I’m incredibly grateful to have been able to benefit from their wisdom. Much of their value was in their ‘bully pulpit’, as they often shared blunt and critical observations on current events and market participant behaviors. However, the core gift they gave to all of us was their willingness to teach us about how to invest if we were willing to listen. Their guidance was clear, understandable, sometimes folksy and often very funny. Constant emphasis of the importance of a competitive moat, how important the price you pay for an asset is, how to wait for the fat pitch, and how a long-term time horizon was critical to success helped reinforce key investment tenets. Their prolific writing (op-eds, books, shareholder letters, etc), long annual meetings answering questions and extensive interviews continuously helped investors learn how to think and invest better.

On life their advice has been just as wise: read as much as you can, have curiosity, do what makes you ‘tap dance to work’, choose spouses, colleagues, friends and associates well and value them, have integrity and help those less fortunate. The curtain is coming down. Buffett advises keeping emotions out of investing, but his departure is a heartbreaker.

Use of any information presented is for general information only and does not represent individualized tax advice, either express or implied. You are encouraged to seek professional tax advice for questions and assistance.

Lariat Wealth Management is a registered investment adviser offering advisory services in the State of Colorado and other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.