Q2 2025: If You Don’t Like the Weather, Wait 15 Minutes

In Colorado we often hear people say: “If you don’t like the weather, wait 15 minutes”. Weather here can change quickly, and beautiful sunny days can turn into intense thunderstorms – important to remember if you’re heading to a baseball game or going on a hike. Just as quickly, skies can clear and we often have rainbows after intense weather.

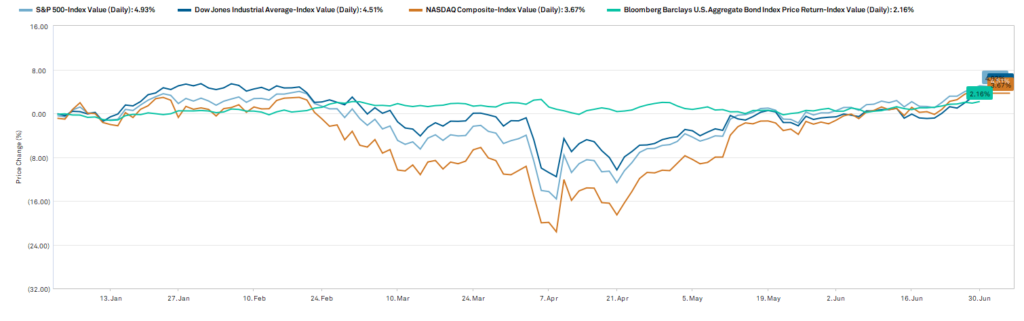

Q2 Started with a Sell-off, Rebound Erased Losses and Markets Finished Higher

The first half of 2025 in the financial markets had a lot in common with Colorado weather. The first quarter started off on a strong footing, but deteriorated rapidly as threats of a trade war and rapidly changing policy announcements undermined business confidence. Early in the second quarter, President Trump’s “Liberation Day” announcement of the imposition of significantly higher tariff levels caused a major market sell-off. Concerns of a potential recession drove markets downward, and the prospect of market-supportive rate cuts by the Federal Reserve were suddenly off the table. However, relatively quickly, the Trump administration announced a pause on the imposition of tariffs until July 9th, and the negative narrative on trade policy was put on hold. Throughout the quarter, better news flow drove improved markets. Corporate earnings remained strong, economic data remained resilient and inflation remained controlled. Artificial intelligence returned as an investment policy theme. It has been a turbulent first half, but equity markets did recover from the sell-off in early April and finished the second quarter with gains.

Through the first half of 2025, the S&P 500 Index, a market-capitalization weighted index which tracks 500 leading U.S. companies, ended up nearly 5% for the year. The NASDAQ Index, which tracks stocks listed on the NASDAQ and tends to be tech company-heavy, increased by nearly 4% on a year-to-date basis through the second quarter, after a signicant drop in April. The Dow Jones Industrial Average, which tracks 30 mature, strong companies, is up 5% through the quarter quarter of 2025. Through the second quarter, the Barclays U.S. Aggregate Bond Index is up nearly 2%.

Source: S&P Capital IQ

Outlook for the Second Half of 2025: Cautiously Positive With Some Wild Cards

Note that sentiment in the markets can change rapidly. After the turbulence of the first quarter, we’re able to return to more ‘normal’ market themes, including what the outlook for interest rates is and what economic growth may be. Note that the market “weather” could deteriorate rapidly, however there are also real positives in our outlook. Key items to watch in the second half of 2025:

- Corporate Earnings: U.S.companies posted strong first quarter earnings of over 12%[1]. Guidance given was unusual, as some companies included tariff effects and some didn’t, highlighting how difficult corporate planning has been. Expectations for the second quarter are lower, at 5%[2], however remain resilient. Artificial intelligence could begin to materially boost corporate margins, and greater certainty will help significantly.

- The “Big Beautiful Bill”: President Trump’s major legislation package is moving through Congress. Corporations will benefit from clarity on tax rates and business investment incentives, however the cost of the bill, which is estimated to add over $3.5 trillion to the national debt, could cause more jitters in the bond market.

- Trade Policy Negotiations: The tariff deadline was postponed through July 9. Trade policy is a complex issue, and closing deals rapidly will be challenging. However, if difficult negotiations end successfully, particularly with China, that will be a market-positive.

- Fed Rate Cuts: The Federal Reserve is faced with considerable uncertainty. Because of the lack of clarity around trade and immigration policy and its effect on inflation, labor markets and economic growth, the Fed has moved to a “wait-and-see” approach to interest rate actions versus the expectation of substantial cuts this year. Should conditions and clarity improve, the Fed could move to cut rates this year, providing a market tailwind.

Conditions remain variable, however additional tailwinds could develop. Note that the major wild cards remain policy-related. There are risks in the markets, including high valuations, a spooky investor base, and the potential for negative surprises. However, as always, a diversified portfolio of high-quality securities remains the cornerstone of long-term investment success. Market downturns are unsettling but remain a normal feature of the financial markets. Being mentally prepared for variable conditions, just like paying attention to the forecast and taking the right gear for bad weather, remains critical to long-term investment success.

[1] J.P. Morgan Markets, 2025 Mid-Year Outlook, 6/25/2025

[2] Factset Insight, 6/27/2025

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. This publication is not intended as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This publication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.