2025 Year-end Review and What to Watch in 2026

Happy New Year! 2025 was the third straight year the financial markets posted strong gains. While the Liberation Day tariff announcement caused a dramatic April sell-off, the markets recovered and surged ahead, driven by the potential for a Federal Reserve rate-cutting cycle, enthusiasm about artificial intelligence and a strong economy. Will this rocket ship powering the equity markets ever come back to earth?

2025 Year in Review

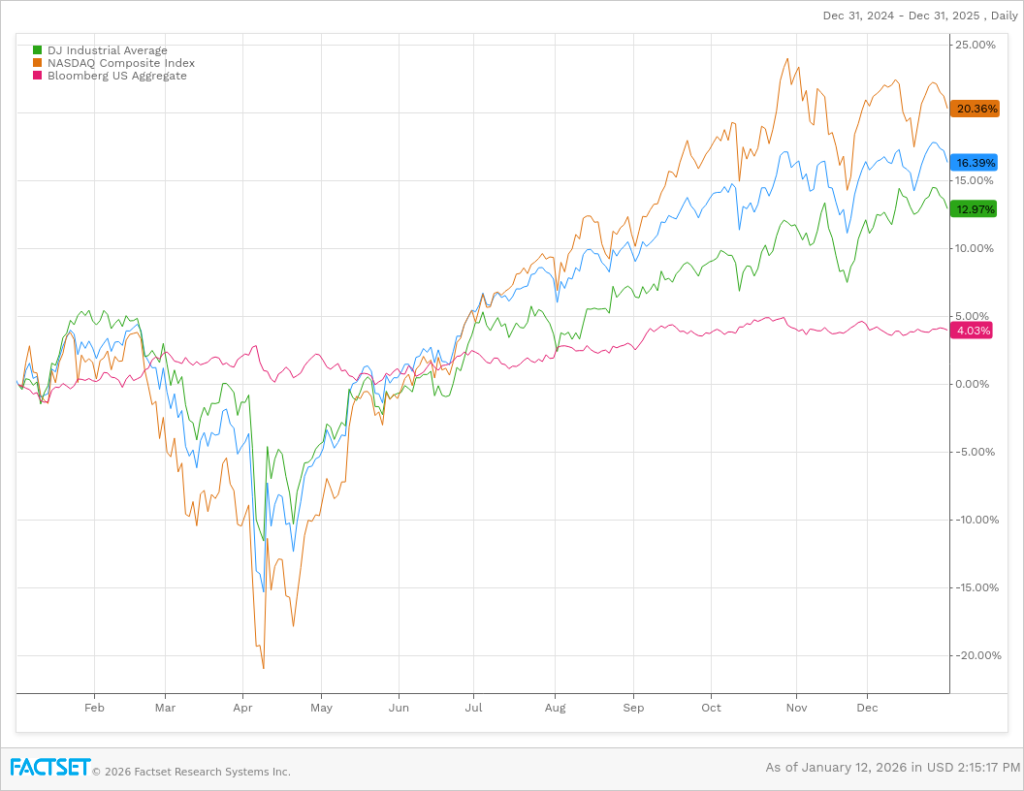

Following double-digit market returns in 2023 and 2024, the S&P Index was up +17%, the NASDAQ up +21%, and the DJIA was up 14% in 2025. These are extremely strong, unusual returns, as ‘normal’ equity market returns are considered to be 5-8%. Since the financial crisis in 2008-09 and addition of stimulus to the markets, returns have averaged +10% per year.

The markets began 2025 on an optimistic footing, following on 2024’s strength. Investors were looking forward to the beginning of a rate-cutting cycle by the Federal Reserve (“Fed”), which typically provides a tailwind to the markets. Market participants were optimistic that the new Trump administration would bring deregulation, market-friendly policies and growth. However, sentiment changed rapidly at the end of the first quarter as investors worried about inflation and a global trade war.

In April, “Liberation Day” pulled the rug out from under the markets. Major indices dropped over 10%[1], and companies faced the prospect of rapidly adjusting their businesses worldwide, without certainty as to what the new rules were. Relatively quickly, the new administration paused the imposition of tariffs. Companies weathered the storm, posting strong corporate earning, and economic data remained resilient. Artificial intelligence returned as an investment policy theme, and markets staged a substantial rebound and ended the second quarter higher.

The markets powered forward for the rest of the year, driven in part by a series of Fed Funds target rate cuts. The U.S. economy remained strong. Outside the U.S., international indices surged. The MSCI EAFE index, a stock market index which tracks large and mid-sized companies in developed countries outside the U.S., increased an eye-popping 31%[2], helped by significant U.S. dollar depreciation and new investment themes (European aerospace & defense, Japanese activism).

2026 Outlook

As we move into the new year, many of 2025’s key themes will persist. Keep an eye on the following:

- The Fed and rate cuts: The Fed cut rates by 75bps in 2025. Currently market expectations in 2026 are for 25-50bps of additional cuts. Note that the Fed has a “dual mandate”, namely, it must support employment and also maintain price stability (i.e., keep inflation in check). Those goals can be at odds, and prompt different interest rate actions. Keeping rates at current levels, or raising them in order to manage higher inflation, would likely cause a negative market reaction.

- Artificial intelligence: AI is a major technological change with significant uncertainty and opportunity, and the AI outlook remains a key debate in the markets today. Despite the potential, skepticism has increased given how much is being spent on AI. When investors will see returns from this spending is unclear. Also unclear is when investors will see meaningful productivity improvement at companies and potential margin improvement, helping stock prices.

- Bond market and long-term interest rates: Public debt in the U.S. is expected to continue to rise and approach 140% of GDP by 2030[3]. With rising debt, investors demand more yield from U.S. Treasuries, which increases medium and long-term U.S. Treasury rates. Rate increases mean that borrowing costs broadly go up, which can slow the economy. Sharp changes in rates, or other changes which undermine confidence in U.S. creditworthiness, can cause disruption in this important but opaque market. That disruption would likely also spill over to the equity markets.

- Political instability and the mid-term elections: As we get closer to the November mid-term elections, sudden policy changes and inflammatory rhetoric will likely increase. The financial markets are influenced by many factors, policy from D.C. being only one factor, however there is the potential for short-term volatility.

There are multiple positive factors driving the markets today. At the same time, risks are building. It’s important to note that after three years of strong gains, more stocks are overvalued. In other words, they are trading at stock prices that aren’t justified by their cash flows. As always, a portfolio of high-quality securities remains the cornerstone of long-term investment success, through ups and downs. After this very long, profitable bull run, a downturn will come at some point, and potentially soon. While unsettling, downturns are a normal feature of the financial markets and should be expected.

Have a prosperous and happy 2026!

[1] S&P Cap IQ. SPX, DJIA, NASDAQ Index Returns from April 2-April 8, 2025

[3] Capital Group Outlook 2026 Edition

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice.