Graduates: Celebrate Your Achievements and Invest in Your Future

Congratulations to all graduates! What an incredible achievement, and a major milestone. For many the next step is the working world and “real life”. You have years of education behind you. Now, looking to the future, there are two basic investment concepts – the power of long-term investing and compound interest (earning interest on interest) – which will serve you well as you start your career and put the money you earn to work for you.

I serve on the Board of the University of Northern Colorado, a 4-year public university based in Greeley, Colorado, and have done so for nearly four years. Originally founded as a teacher’s college in 1889, today UNC provides undergraduate, graduate and doctoral-level programs ranging from education to health sciences, business, humanities and the performing and visual arts. I’m proud that UNC is a leader in social mobility – it will officially become a Hispanic Serving Institution, and over 40% of our undergraduates are the first in their families to attend college.

One of the incredible perks of the job is attending UNC’s graduation ceremonies. Graduations are particularly special. They are an official transition point: you have completed required coursework and requirements for a degree and are finally awarded that degree. Graduations are also a time to reflect on and celebrate your hard work and the dedication of the faculty and University administration to your success. They are also a time to honor and thank family and friends for their support. Many of you have overcome significant financial and personal adversity, and you have persisted through the difficult “dark days” of Covid. Your degree reflects not just the educational credits acquired but your determination, resilience, grit, sacrifice and courage.

As you begin to transition from the academic world to the working world, you’ll have real life financial issues to worry about. You’ll be tossed into the confusing world of paychecks, tax withholding, benefits choices and retirement plans. You’ll be independent, maybe for the first time – paying rent, bills and managing expenses on your own. You will need to be financially organized. This includes creating a budget, paying bills on time, repaying student debt, paying taxes, monitoring your credit, and last but most important, saving and investing.

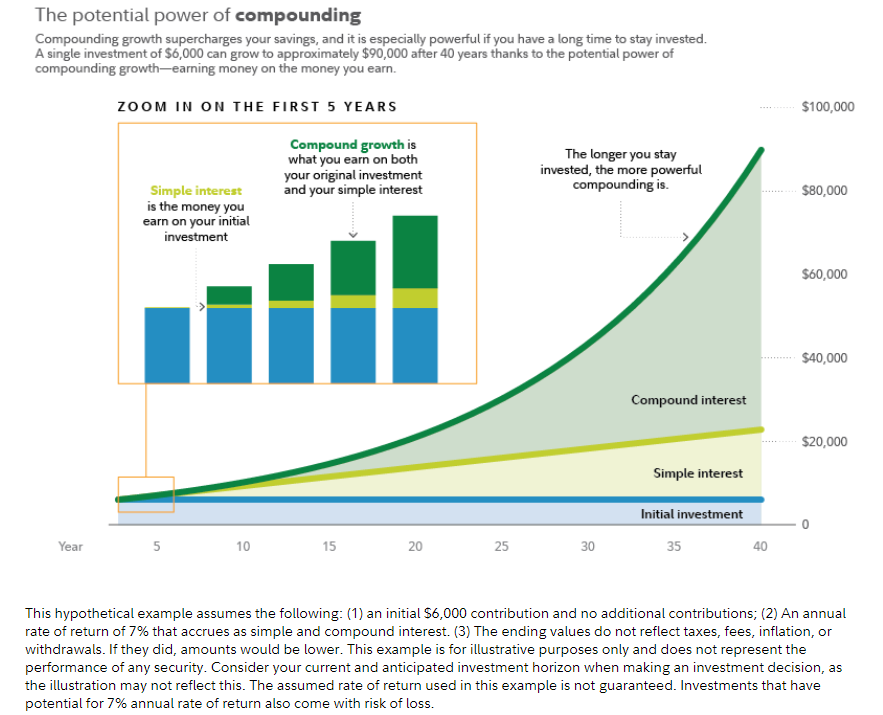

It’s an easy time to get overwhelmed, but remember, you have two powerful tailwinds working for you as you begin to invest: time and compound interest. You are young, which means you have a long “investment horizon”, or total length of time you can invest. Time plus the power of compound interest (returns not only on your original investment but on the interest earned as well) are rocket boosters for your investment portfolio.

This is how compounding works:

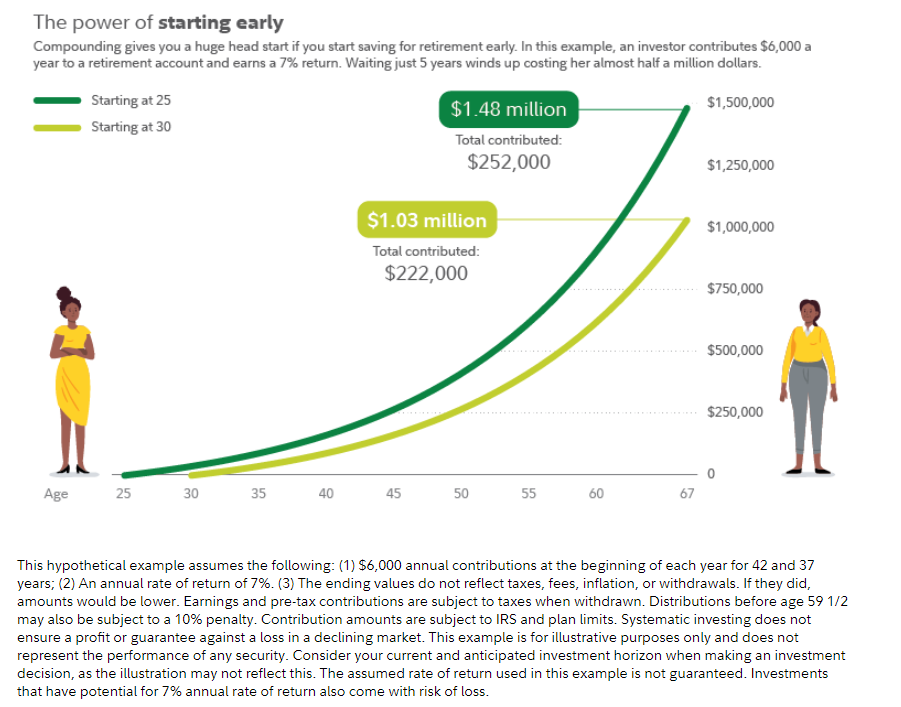

And this is how big a difference it can make if you wait!

Source: https://www.fidelity.com/learning-center/trading-investing/compound-interest

Adding to your account on a periodic basis – every pay period, month or year, magnifies these effects further.

While it may be daunting to even think about, here are a few first steps as you start your investment journey with the goal of building wealth for yourself and your loved ones over time.

- Think long-term and set a goal: investing and building wealth take time and patience. Most of us don’t think out further than a few days into the future. Take the time to dream for a moment – imagine what you most want out of your life and financial circumstances when you’re 30, 40, 50 years old and beyond – and aim for that.

- Maximize retirement account contributions: at a new job, if you have a 401K or retirement plan as a benefit, maximize it! An “employer match” is free money – understand your benefit and how to maximize it (Human Resources can help). Otherwise open a Roth IRA (depending on your circumstances) and maximize contributions to that. Fill up tax-advantaged accounts (including Health Savings Accounts) before anything else.

- Budget: Knowing what and how much you spend is key to having money left over to invest. Budgets aren’t fun, but they are empowering. You’ll know how much you earn and where it goes, so you can spend intentionally and maximize savings and investments. Consider budgeting as a critical step toward your long-term goals and remember, the more you have left over to invest, the faster you’ll get to your goal.

- Again, remember the two key drivers to investing: TIME and COMPOUNDING. These powerful forces combined mean that small investments today can grow substantially over time – you are putting your money to work for you. Think of a garden, where you plant a few seeds, and then a few more. With time and patience, you’ll have a substantial harvest.

Again, congratulations to the graduates! We are so proud of you.

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Views expressed are as of the date published or sent, based on the information available at that time, and may change based on market or other conditions.