Happy New Year and thank goodness it’s 2023. Some years are a relief to close the books on, and 2022 was one of those years. It was a challenging and unusual year in the markets. Macroeconomic factors were the primary driver of investment returns in 2022, as inflation surged to 40-year highs and the Federal Reserve Bank (the “Fed”) rushed to contain it, raising the federal funds rate at an unprecedented pace. The rapid, forceful tightening, akin to pulling the emergency brake on a car speeding down a highway, cratered the bond markets, pushed equity markets into bear market territory, and increased the prospects of a potential recession in 2023.

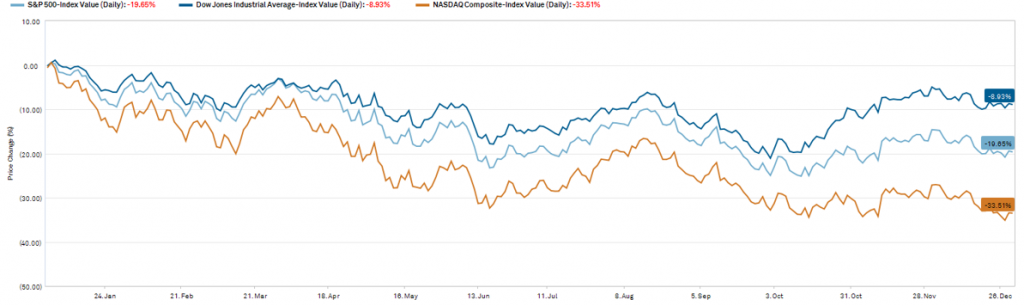

The contrast between 2022’s investment returns (-20% for the S&P 500 Index) versus strong performance in 2021 (+27%) and 2020 (+16%) has left market participants with severe whiplash and unease about the future path of the markets. Russia’s invasion of the Ukraine in February, midterm election “noise” leading up to the November elections, a dramatic sell-off in previously market-leading stocks and the implosion in value of cryptocurrencies added to the mess in 2022.

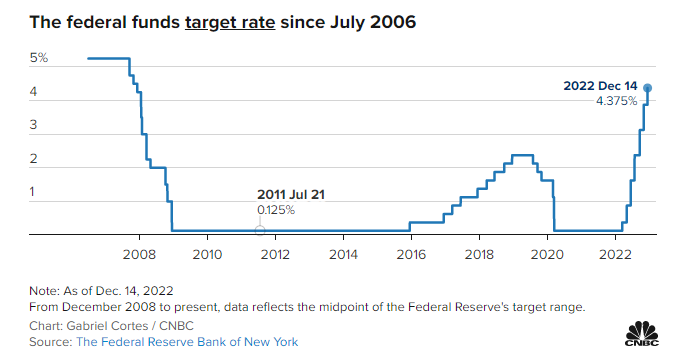

The Fed’s Fight to Tame Inflation: Inflation accelerated rapidly in 2022. The Fed’s primary monetary policy tool for fighting inflation is the federal funds (“fed funds”) rate, which is the target interest rate set by the Federal Reserve’s Open Market Committee. Raising the fed funds rate increases borrowing costs in the overall economy. The idea is that as borrowing costs rise, the economy slows, and inflation decelerates. Higher unemployment and a potential recession are major risks of raising rates. Because the Fed’s actions were extreme, raising rates by a significant amount in a short period of time, the risk of a policy error and a significant recession are higher.

In addition to increasing the fed funds rate, the Federal Reserve also pulled back on additional stimulus it was providing the market through the large-scale purchase of bonds. This program, called Quantitative Easing (“QE”), provided additional liquidity to the economy and markets. This withdrawal of stimulus further tightened monetary conditions.

Major Declines in Financial Markets: The Fed’s rapid tightening precipitated a dramatic market sell-off throughout the year. The S&P 500 Index, which includes the largest 500 companies in the U.S. and has a large weighting of large-cap technology companies, hit bear market territory, down -25% at its low in October, and closed 2022 down -20%. The technology-skewed Nasdaq composite closed the year down -34%. The Dow Jones Industrial Index, made up of mature, lower-growth companies, was a relatively stronger performer, with investment returns of -9%.

The bond market saw unprecedented losses. The Bloomberg U.S. Aggregate Bond Index declined nearly 15%[1]. The yield curve inverted, and short-term Treasury yields exceed long-term yields. This typically occurs when investors anticipate a period of recession. While a yield curve doesn’t guarantee a recession is imminent, it does indicate that the prospects for recession are higher.

What’s In Store for 2023: Despite that, 2023 has the potential to be a more stable year, with attractive values in the equity market and higher yields for investors in the bond and cash markets. While the Fed has emphasized its commitment to reining in inflation at the cost of risking a recession, the possibility still exists for a soft landing for the economy and a gradual easing of rates as inflation cools. This is not to say that a recession won’t occur, as the Fed’s policy actions may trigger a more significant slowdown than currently expected. Peace in the Russia/Ukraine conflict and diminishing tensions with China would boost markets as well. The range of outcomes remains wide.

The most encouraging factor in today’s markets for investors is that many more stocks are trading at attractive valuations after the market correction. As negative sentiment increased in 2022, and prices fell, many high-quality stocks, previously too expensive to buy, are now at good prices. Much of the froth and speculation has come out of the market, and attention has started to return to company fundamentals, including earnings and free cash flow. Long-term secular growth themes are also a reason for positivity as we think about the next several decades in investing. The adoption and implementation of 5G, the much-derided but very interesting metaverse and the potential applications of quantum computing and artificial intelligence are fascinating areas for investment research as technologies mature and new market opportunities arise. As always, having a long-term view and remaining invested through the market cycles in a balanced, diversified portfolio of high-quality securities remain the keys to building long-term wealth. Near-term periods of correction, while painful, are part of investing.

[1] S&P Capital IQ

—

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.