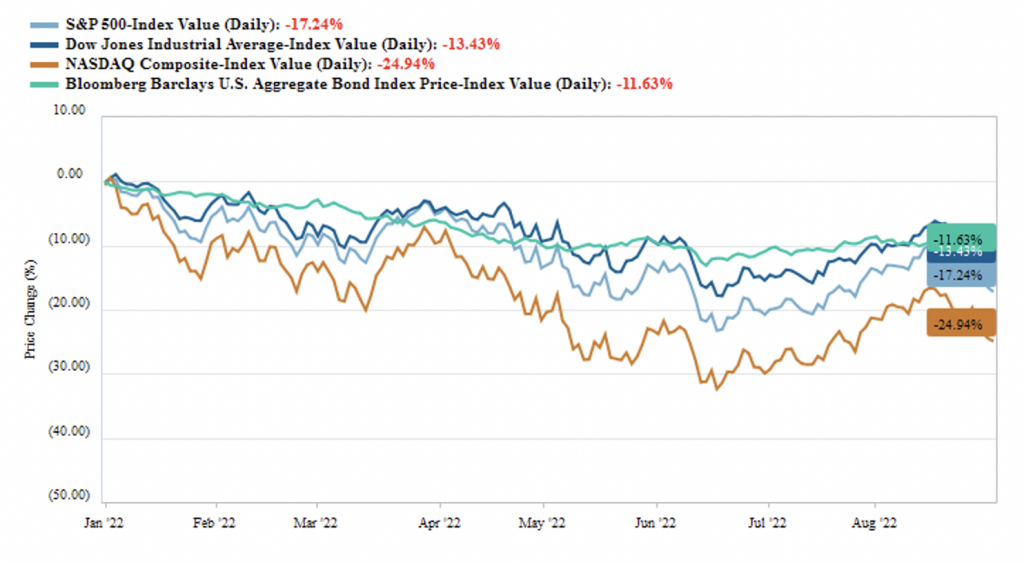

It’s been quite a summer in the markets. After the weak start to 2022, the markets rebounded substantially in June and July. The S&P 500 Index was up 9.1% for the month of July alone. This strength did not last and was followed by a rapid sell-off in August. On a year-to-date basis, the S&P 500 Index was down -17% at the end of August. The Dow Jones Industrial Average, comprised of more mature companies, is down -13% for the year, and the Nasdaq Composite Index, which includes higher-growth companies declined nearly -25% through the end of August. The fixed income markets have provided no place to hide, and the Bloomberg US Aggregate Bond Index is down nearly -12% year-to-date.

The whipsawing in the markets has been caused primarily by the Fed and changing expectations of the future path of interest rates as inflation remains at high levels. Rising geopolitical risk and midterm election “noise” have also been feeding into investor concerns. While there remain many positives, including a resilient U.S. economy, strong labor market, and healthy corporate and household balance sheets, as we move into fall market volatility is likely to continue and may increase.

The Fed’s Challenge: Raising Rates and Quantitative Tightening Without Causing Real Harm to Markets and Economy

- Big rate hikes: The Fed has emphasized its intention to regain control over inflation. To do so, it will continue to increase the Fed Funds rate. The Fed Funds rate is the target interest rate set by the Fed and is the rate at which commercial banks borrow and lend to each other in the overnight market. The premise is that raising borrowing costs reduces spending and the demand for goods and services, and prices will drop in response, bringing inflation down. The Fed has already raised the target rate four times in 2022 and may raise by an additional 75bps in September. In December, another 25-75bps hike is possible. At the end of the year, the Fed Funds rate is estimated to be within 3.5-4%.

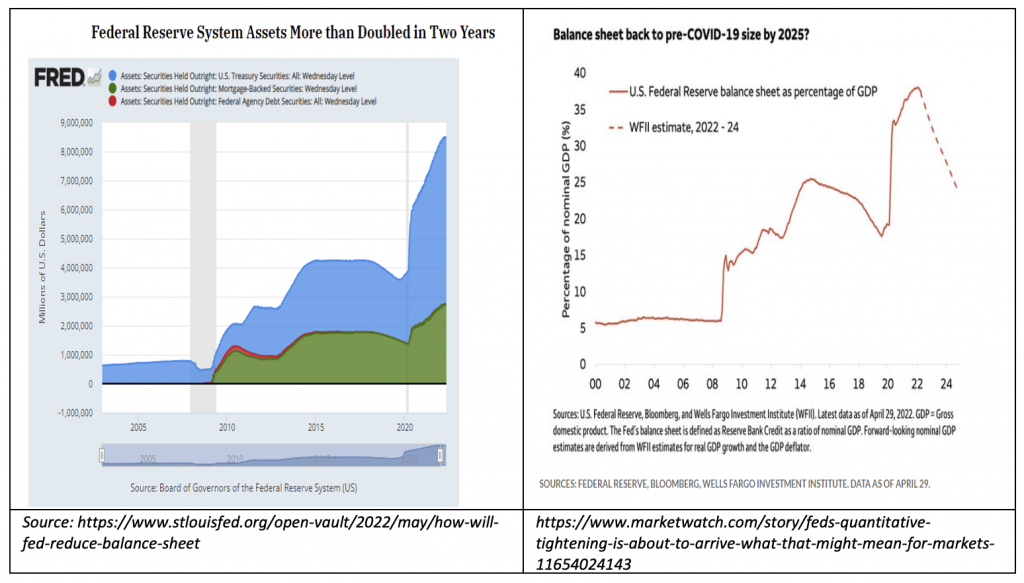

- Quantitative tightening to speed up in September: In addition to its commitment to raise the Fed Funds rate to combat inflation, the Fed announced in May 2022 that it will withdraw the substantial liquidity it had provided to the markets and economy after the Global Financial Crisis and the Covid-19 pandemic crash. The Fed will reduce the size of its balance sheet, which has ballooned to $8.5 trillion[1]. In September this Quantitative Tightening (“QT”) will increase to a maximum $95bn/month, as the Fed lets its securities holdings mature. While communicated by the Fed over the past year, QT has been lost in the narrative around interest rates and inflation and could result in disruptions in cash and debt markets, particularly as there was little movement in QT this summer. Using both policy tools at the same time is relatively uncharted territory.

- Fed will risk a recession to get inflation under control but may be able to thread the needle: Citing Fed Chairman Paul Volcker’s restrictive policy actions in the 70’s, Fed Chairman Jerome Powell emphasized recently that a restrictive monetary policy would be implemented for a prolonged period, if necessary, to break inflationary expectations, and will cause “some pain”[2]. Because the Fed can affect only the demand side of the economy by changing monetary policy, and not the supply side, which has been distorted by supply chain problems, there is a heightened risk of policy error. Tightening too rapidly could cause a deeper economic slowdown than was necessary. However, supply chain improvement and a potential resolution to the war in Ukraine could help ease commodity markets and the global flow of goods, reducing the grip of inflation on the economy sooner rather than later.

Additional Sources of Volatility: Geopolitical Risk, Midterm Election Noise

- Rising risk in China: China’s housing crisis and new Covid lockdowns have weakened its domestic economy, creating near-term disruption and a slowdown in growth. Separately, relations between the U.S. and China have become increasingly tense as China’s belligerence against Taiwan escalated. Taiwan is particularly sensitive as its attack would threaten the global supply of semiconductors. China has been the world’s growth engine, and that growth trajectory is likely to slow at least in the near-term.

- Russia escalating Ukraine conflict: The Russian invasion of the Ukraine has seen limited success over the past six months. The West has provided substantial support to the Ukraine in the form of funding and the provision of advanced weaponry and training. This conflict roiled the commodity markets, raised the threat of a nuclear emergency at Europe’s largest nuclear facility and has destabilized Europe. Most recently, Russian President Vladimir Putin has cut off supplies of natural gas to Europe via the Nord Stream pipeline, causing energy prices to spike and preliminary plans for rolling blackouts and factory shutdowns as winter approaches. Putin’s invasion has not resulted in the easy territorial gain and show of force he hoped for. The concern now is that Putin, faced with a potential failure in the Ukraine, may resort to more extreme measures.

- Midterm elections – noise to increase over next few months: As with any political campaign season, this midterm election season has been full of jabs and exaggerated claims. The noise will intensify over the next few months as the parties fight for control of Congress, in particular the House of Representatives. Should control of the House go to the Republicans, it is likely that we have gridlock and limited new legislation, with a continuing high level of vitriol. No matter what happens in terms of party control, a definitive outcome, particularly if it is gridlock, will be beneficial for the markets.

Numerous Positive Factors Remain

Balanced against these heightened risk factors are positive factors as well.

- Economic indicators hanging in there: Even with higher interest rates, economic activity does not appear to have dramatically slowed, at least not yet. The job market remains strong. Consumers have been relatively resilient, despite higher inflation, and household leverage remains low. Although manufacturing activity has slowed and some companies are faced with too much inventory, in general companies have high levels of cash and strong balance sheets, and many capitalized on low-cost fixed rate debt. Earnings expectations for 2022 have come down to 7.9% from ~9% earlier this year[3], primarily due to Q3 cuts. Supply chain bottlenecks are improving, finally. And should the inflation rate peak and begin to decline in the fall, the market will likely respond positively.

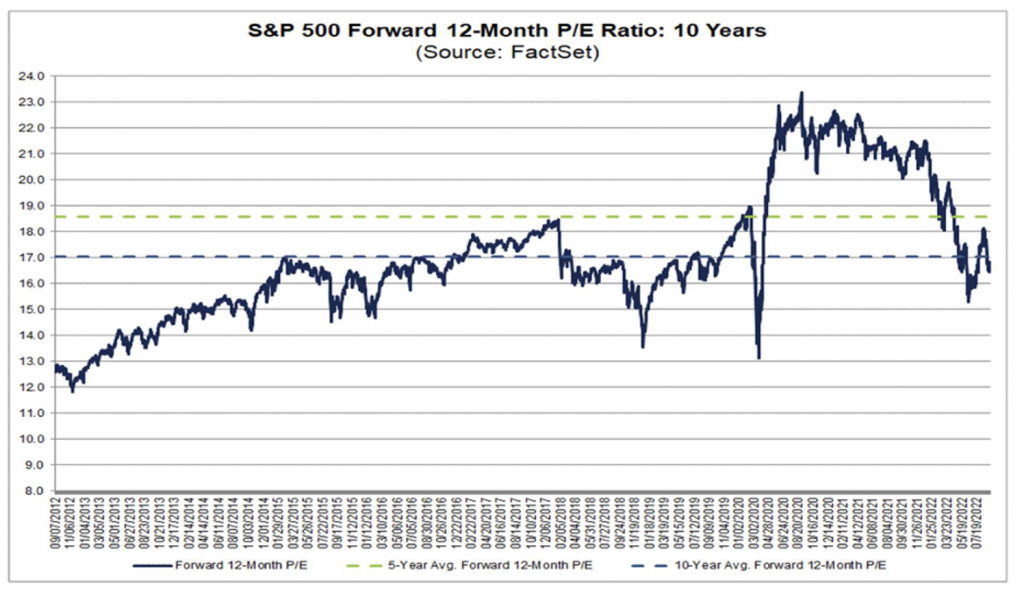

- Lower valuations, finally: Most importantly, there is much more opportunity in the markets today as stock valuations have declined. Today’s forward Price to Earnings ratio, a widely used measure of how expensive stocks are, has decreased substantially and is below the 10-year average. Market sentiment and expectations remain negative, for the reasons outlined above. While earnings may come down further, often the markets can become overly negative, providing attractive investment opportunities. While counterintuitive, the best time to buy stocks is when things feel worst.

- Rising rates means higher yields for investors: As well, investors are finally being paid for their short-term money, and bond yields have risen. Many income-oriented investors can look to a near future of a higher-yielding balanced portfolio.

As always, even when the market turbulence intensifies, it’s important to stay the course and invest for the long-term.

—

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Indexes are unmanaged. It is not possible to invest directly in an index. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

[1] https://www.stlouisfed.org/open-vault/2022/may/how-will-fed-reduce-balance-sheet

[2] https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

[3] Factset Earnings Insight, 9/9/22