Welcome to Lariat Wealth Management’s inaugural e-newsletter, In the Loop. In the Loop will be posted on a monthly basis, and will include market observations and insights, key trends to watch, and personal finance topics and reminders. Thank you for reading!

Market Outlook for 2022: Continuing the Return to Normal

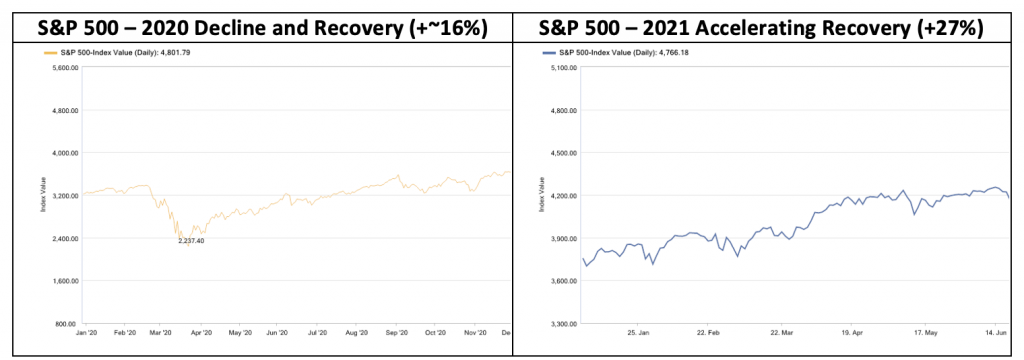

2021 continued 2020’s post-Covid recovery: The rapid market decline in March 2020 resulting from the initial onset of the Covid-19 pandemic was short-lived. By the end of 2020 the equity markets were well on their way to recovery. While our lives remained in a state of abnormality – working from home, mask-wearing, Covid scares, scheduling havoc – in 2020 the S&P 500 index improved by nearly 16%.

In 2021, Covid-19 vaccines were widely deployed and the government continued to provide significant support to the markets. Corporate profits grew substantially and consumer demand improved. Aided by accommodative monetary policy, the economy and markets continued to recover throughout the year, and despite several episodes of elevated volatility, the S&P 500 posted strong investment returns of 27% for 2021. 2021 also saw the emergence of higher inflation, caused by stimulative policies, supply-chain bottlenecks, high commodity prices and labor market dynamics.

Source: S&P Capital IQ Pro

Temporary market “boosters” to abate in 2022: As we move into 2022, the fiscal and monetary policy support enacted to prevent a severe recession, including assistance to individuals and businesses, and stimulative monetary policy (including low interest rates), will be reduced. While we still face short-term potholes in the road, including new Covid-19 variants and supply chain challenges, the U.S. economy is well on its way to more normal growth. Because we are in a healthier economic environment which has shown signs of inflationary trends, the Fed has signaled that it will continue to taper (reduce the amount of assets it purchases) and will begin to raise interest rates in 2022.

Will the strong markets continue? It’s important to remember that the markets have had artificial support since March 2020, when the Fed aggressively intervened to avoid a recession. That support was largely successful. As the support is withdrawn and we return to normal, it is important to remain realistic about market prospects going forward. Despite the current largely positive backdrop, risk factors are elevated and equity market returns are likely to be lower in the future than the double-digit returns we have seen in the recent past. There are numerous, positive tailwinds for the equity markets in 2022, including:

- Strong corporate earnings: S&P 500 companies reported record-high levels profit growth of over 45% in 2021, rebounding from 2020’s weakness. Expectations for 2022 earnings growth are for still-solid 9% earnings growth, according to Factset’s Market Insight[1];

- Consumer strength: high savings rates and strong equity and housing markets have increased household wealth substantially. Moody’s Analytics estimates that consumers have built up a stockpile of $2.7 trillion of “excess savings”[2];

- Supply chain disruptions likely to ease: improvements in production and shipping capacity are expected to improve in 2022, and short-term demand spikes may ease as inventories return to more normal levels;

- Covid-19 risk may finally fade: The most recent omicron version of the virus is highly contagious and is rapidly moving through the US and world populations. Between those who have been previously infected with Covid, those who are vaccinated and boosted, and new therapeutics, at some point we may achieve some type of herd immunity. While eradication of the virus seems unlikely, it may become an endemic illness rather than an extreme health threat in 2022.

The following rising risk factors may add volatility throughout the year:

- Inflation: the key debate in the market currently is whether 2021’s high inflation levels are transitory, and how long-term price levels will develop. The lack of clarity around inflation has raised concern of a policy mistake by the Fed, namely that it would mis-gauge interest rates and respond too aggressively by raising interest rates too much in response, which risks a rapid economic slowdown and “stagflation”;

- Valuation levels: the S&P 500’s current forward P/E (price/earnings) ratio is 21.2, well-above the 10-year average of 16.6x[3]. This suggests that the market, or constituents of the market, may be prone to correction;

- Rising interest rates: the Fed has clearly signaled that it will begin to raise short-term interest rates in 2022. The U.S. has benefitted from low interest rates and easy credit conditions since the Global Financial Crisis in 2008. Rising rates, particularly if they increase more rapidly than expected, will impact the fixed income and housing markets, and are likely to cause volatility;

- China’s property crisis becomes uncontained: China’s housing market, which comprises a substantial portion of the Chinese economy, has been in decline this year as highly-indebted property developers face financial distress and default. Given the importance of the real estate sector to the Chinese economy, Premier Xi Jinping is attempting a controlled workout of the sector. Growth in the world’s largest economy has already slowed; an economic crisis could have material global ramifications.

2022 outlook positive, with elevated risk factors: As we move into the new year, the market backdrop remains positive. Consumers and businesses are in strong financial shape, and the economy has improved substantially and we are nearly back to normal. However, there are several risk factors to be mindful of, most importantly the future path of inflation, higher interest rates and extended valuation levels.

Markets with higher volatility, particularly if we have significant drawdowns, create fear and dread, but often are the best markets to invest in. To quote Warren Buffett, “The sillier the market’s behavior, the greater the opportunity for the businesslike investor”.

Happy New Year and All the Best for 2022!

Disclosures

Any opinions expressed herein are our current opinions only and are subject to change. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Past performance is not a guarantee of future results. Investment advisory services offered through Lariat Wealth Management, LLC, a registered investment advisor with the State of Colorado, located in Denver, CO. Lariat Wealth Management, LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Please make sure to call or email Lariat Wealth Management to discuss any changes to your financial situation, investment objectives or/or limitations. 01/2022

[1] Factset Earnings Insight, 12/17/21

[2] “Vast Household Wealth Could be a Factor Behind the U.S. Labor Shortage”, Josh Mitchell, Wall St. Journal, 12/19/21

[3] Factset Earnings Insight, 12/17/21