In the Loop: February 2022

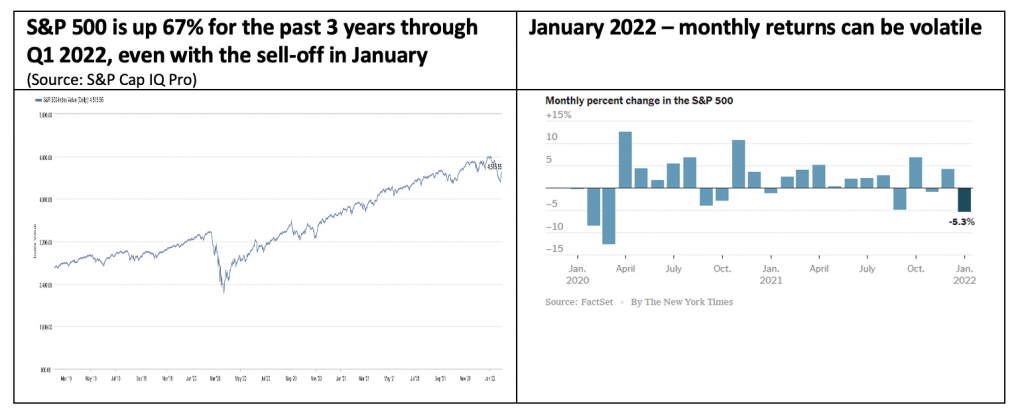

The old cliché, “markets don’t like uncertainty” can be expanded to “markets don’t like uncertainty or punch bowls being taken away”. After three years of unusually strong equity market returns, 2022 started off on a with high market volatility as investors worried about inflation and the pace of monetary policy tightening. The “punch bowl” metaphor is from William McChesney Martin, who was Fed Chairman in 1955 and said that the Fed “is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”[1]

Accommodative monetary policy tools (the “punch”), including very low interest rates, were used to boost liquidity and stimulate the economy after the Global Financial Crisis and the Covid-19 pandemic caused a market crash in March 2020. Today, the policy support has largely worked, and an improved economic environment and rapidly rising inflation has prompted the Fed to pull back on the substantial policy support it is providing. As the Fed continues to reduce, and ultimately end, its quantitative easing program and begin to raise short-term interest rates, the volatility is likely to continue and may worsen.

As the Fed pulls back its support, the financial markets and economy will go through an adjustment period, and the markets will remain in a state of uncertainty and reaction. Market participants are in the process of reassessing what securities are worth in a lower-growth, higher interest rate environment and how they want to be positioned, and January 2022 was marked by large intraday moves in the market, rapid sell-offs and dramatic recoveries.

The technology sector was hard-hit in January, and stocks with high valuations or generating losses were particularly vulnerable. Many former pandemic high-fliers, including Netflix and Peloton, are down substantially. The S&P 500 nearly reached correction territory, defined as down 10% from the recent peak, several times during the month, however improved and finished January down -5.3%. The tech-heavy NASDAQ posted a nearly -9% loss in the first month of the year. The Dow Jones Index, comprised of mature, blue-chip companies, was off -3.2%.

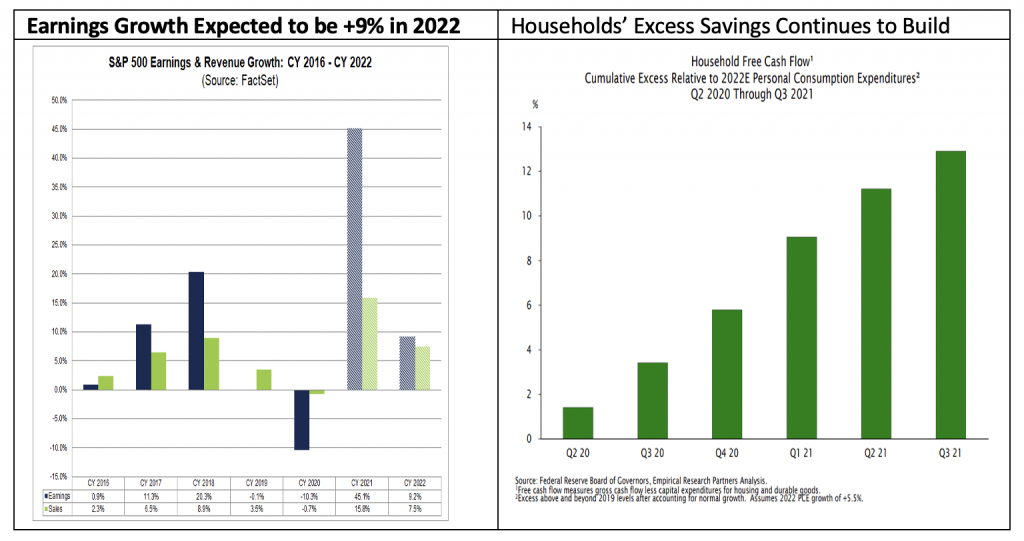

While we are in this adjustment period with less visibility and higher volatility, there are numerous positive factors to consider as we move into 2022. Corporate earnings, which grew rapidly in 2021 as companies bounced back from the 2020 shock, are on track for further growth (see chart, below left). As well, consumers are in a strong position, with manageable debt positions and high levels of excess cash (see chart, below right). The labor market is strong, albeit unusual, with high job openings and worker turnover. The strong housing market and double-digit recent financial market returns have created significant wealth. Inflation, driven higher in part by supply-chain disruptions, could begin to rise less rapidly. And most hopefully, there is the potential for the Covid-19 pandemic to be contained or end.

Despite the choppy markets, the market outlook is neutral to favorable. We’ll just need to keep our seat belts on for the near-term as we move through the turbulence.

Disclosure: The information contained herein is based on sources that are believed to be reliable. Any statements nonfactual in nature herein constitute only current opinions or estimates, represent only the current judgment of the author, and are subject to change without notice.

[1] Wm. McC. Martin, Jr. Chairman, Board of Governors of the Federal Reserve System, Address before the New York Group of the Investment Bankers Association of America. 10/19/1955