Market Update: What the Invasion of Ukraine Means for the Markets

In the Loop: March 2022

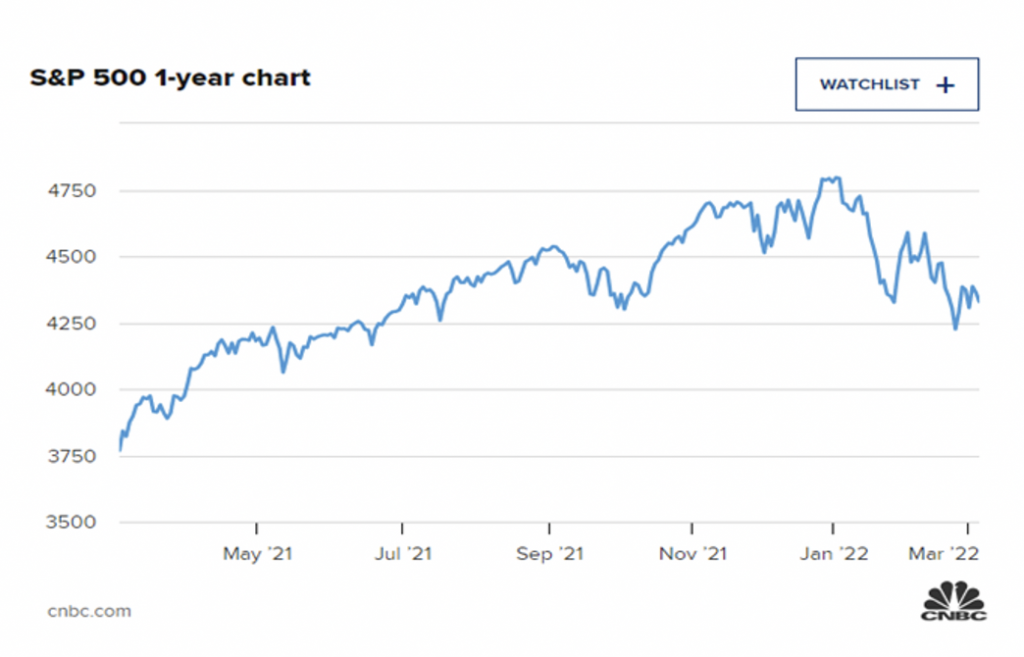

2022 has begun with heightened market volatility, caused both by changes in U.S. monetary policy and by increasing geopolitical risk. In January the market was focused on how much the Fed would raise interest rates, and how fast, as inflation measures continued to rise. After a bit of a relief rally at the end of January and beginning of February, concerns of an imminent attack on the Ukraine rose as Russian soldiers amassed on the Ukrainian border, rattling markets and spurring a “risk-off” move to safer securities. The invasion intelligence agencies had been warning of became reality on February 24th, as Russia attacked the Ukraine, and markets globally declined on the news. This invasion and how the conflict develops will be critical determinants of global stability and the recovery of financial markets. A brief overview of the historical context to the invasion of the Ukraine and Russia’s goals are helpful when considering the range of potential outcomes.

Background on the Ukraine Conflict and Putin’s Goal of Re-establishing Soviet Power

The Ukraine has become the latest former Soviet country Vladimir Putin, the authoritarian leader of Russia, intends to pull back into the post-Soviet Russian sphere of influence. The modern roots of the crisis can be traced back to World War II and the post-war world order, which was dominated by the intense rivalry of two superpowers, the US and the Soviet Union. The two blocs had opposing ideologies – freedom, liberal economies and democratically elected governments versus controlled societies, planned economies and socialist governance systems. Called the Cold War because while there were some close calls, there was never outright military conflict between the two nuclear powers, instead the war was waged via propaganda, influence and proxy wars.

After decades, the Cold War finally ended in 1989 with the collapse of the Berlin Wall, after then-Soviet premier Mikhail Gorbachev began to liberalize the Soviet economy. After the fall of the Wall, while the tension had lessened, the two spheres of influence remained, albeit with a significantly weaker Russian state. Formerly Soviet republics held elections and declared independence from the Soviet Union and some, including Ukraine, began discussions to join NATO and the EU. NATO, the North American Treaty Organization, was formed in 1949 as a Western security alliance to counterbalance Soviet expansionism and promote European integration[1].

Vladimir Putin, a 70-year-old former KGB officer stationed in Dresden, East Germany, during the fall of the Wall, and head of the FSB (Russia’s intelligence agency) became acting President of Russia in 1999 and was elected President in 2000. Putin has been in power since then in varying positions through increasingly autocratic means, including jailing political opponents, interfering in elections, controlling media and expanding the geographic territory under his sphere of influence. He has been strongly against the expansion of NATO and the EU to include former Soviet countries and views the expansion as threatening.

Ukraine matters to both Russia and the West as it is a large, strategically located country between Europe and Russia with key ports on the Black Sea. After the fall of the Wall, the Ukraine had the world’s third-largest nuclear arsenal[2], which it relinquished rights to in the Budapest Memorandum, which it signed in 1994 in return for security guarantees from the UK, the US, and Russia. It was largely agrarian, poor and dependent on Russia for energy and key commodity inputs.[3] Its history was brutal, marked by German occupation and exploitation during World War II and forced Soviet industrialization. Following its independence in 1990, economic development was challenged, marked by GDP contraction, hyperinflation and extreme budget deficits. Political instability and corruption further hindered the development of the newly independent country.

Over the decades NATO steadily expanded, and former Soviet countries including Poland, Romania and the Baltic states joined the security alliance. Ukraine was alternately led by Russian-allied and pro-Western leaders, and in 2008, the pro-Western, democratically elected President, Viktor Yushchenko, formally requested that Ukraine be considered for membership into NATO. Yuschenko had survived being poisoned during his campaign, and blamed Russia for the attack. NATO confirmed that it would like Ukraine to join at some point, but its application was shelved indefinitely.

In 2010 a pro-Russian leader, Viktor Yanukovych, was elected and discussions with NATO and the European Union failed. Yanukovych jailed political opponents and mass protests spread across Ukraine, ultimately forcing Yanukovych out of office. Russia, in response to the unrest, accused Ukraine of a coup, and in 2014 Putin moved Russian troops into Crimea and annexed the region. As well, Russia incited separatist movements in the eastern Donbas region of Ukraine[4]. Western countries imposed an initial round of sanctions, which had negligible deterrent effect on Russia’ behavior.

Ukrainian public interest in joining NATO and the EU strengthened after Russia’s move into eastern Ukraine. At the same time, Russian rhetoric and formal demands escalate against Ukraine joining NATO. Discussions with the EU, called the “Eastern Partnership Program” are held with Ukraine, and several other former Soviet countries also struck association agreements with the EU. Russia, attempting to manage the situation in Ukraine, continued its less obvious attacks on the country, via propaganda, cyberwarfare, and regional conflict. In 2019 former comedian and actor Volodymyr Zelenskyy was elected president. His campaign commitments included making peace with Russia and ending the war in Donbas.

In 2021, Russia amassed nearly 100,000 troops near the border, and Zelenskyy, alarmed and assuming an imminent invasion, asked NATO leadership to be put on a membership track. NATO once again denies the request. The diplomatic demands from Putin continue, with Russia demanding that Ukraine be barred from membership in NATO and that NATO withdraw troops from countries which joined after 1997. In early 2022 diplomatic efforts fail. Russia attacked the Ukraine on February 24th.

Implications of the Russian Invasion for the Financial Markets

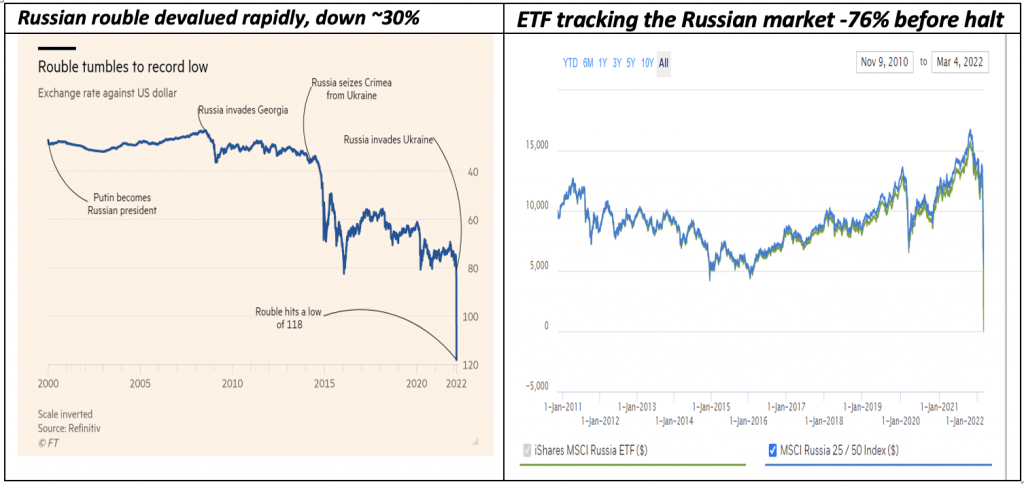

After the Russian invasion, there was a rapid and unprecedented global response. Onerous sanctions were immediately imposed on Russia (notably excluding energy exports), Putin, and his circle of oligarchs. The sanctions included withdrawing the ability of certain Russian banks to access SWIFT, the international financial communications system. The Russian stock market has been kept closed, the Russian ruble has lost 30% of its value and the Russian central bank raised interest rates to 20%.

Source 2: www.ishares.com/us/products/239677/ishares-msci-russia-capped-eft#/

The Europeans, with surprising unity, acted rapidly. The Germans, previously loathe to engage in the conflict at all given their history and dependence on Russia’s energy, abruptly cancelled the Nord Stream pipeline project, approved the shipment of German weapons to Ukraine and allowed other countries to ship weapons to Ukraine as well. Numerous countries, including many European countries, Canada and the UK have shut down airspace to Russian flights. Switzerland, historically neutral, moved to freeze the assets of sanctioned Russians. Yachts and other assets have been frozen, and in some cases seized, across Europe.

Companies are also engaging in the fight. Facebook has clamped down on false Russian propaganda, Microsoft shut down a Russian cyberattack on the Ukraine, Apple announced that it will stop selling products in Russia, energy companies including BP are divesting major fossil fuel assets and ending partnerships in Russia, aerospace and auto companies have ceased shipping products and parts, banks have curtailed financing activity and consumer companies are suspending operations in Russia. Hackers have taken up the cause as well, shutting down Russian governmental websites.

This quick, unprecedented, unified economic response will likely hasten the negative impact of sanctions, which typically are effective but take time to produce results. The bravery of the Ukrainian people and the unexpectedly strong wartime leadership of President Zelenskyy have galvanized the world. Russia appears to have underestimated the Ukrainian defense and now is facing a more costly, brutal and longer war than originally anticipated.

The fact is that the Russian threat to world order has increased, as Putin has moved on from smaller territorial annexations to full-scale invasions of sovereign countries. His leadership, ambitions and willingness to act have made the world fundamentally less safe.

There is a broad range of outcomes for this conflict, and for the future trajectory of the market. Two potential outcomes are:

- The Ukraine successfully defends itself against Russia, ultimately joins NATO and EU;

- Russia occupies Ukraine as a hostile force with a puppet government. Putin could then regroup and continue on to take over other formerly Soviet countries;

- A negotiated outcome is reached between Russia and the Ukraine, supported by the West.

The first option would be a favorable outcome, precipitating a faster track for the Ukraine to join the Western allies. This would weaken Putin’s position in Russia and potentially create a turnover in leadership. This is the better outcome but has the highest near-term risk that Russia resorts to using brutal weaponry, including nuclear weapons, as it loses the battle for Ukraine.

The second option just kicks the can, fundamentally destabilizes Europe and doesn’t solve the issue of an imperialist Russia. Russia, emboldened, will likely invade and occupy other countries. An invasion of a NATO country has the potential to prompt engagement by the US and other allies, and a broader war.

The third option, depending on the agreement, would be a diplomatic victory and would have the potential to bring more lasting peace, however is the least probable. An outcome that is anything but what Putin is aiming for is unlikely.

Either of the first two options have the potential to weigh significantly on the world stability and on financial markets for the short-term, leading to a potential, unstable recovery once a new normal, either Western or Russian, is reached. If Putin is overthrown or if there is a real diplomatic resolution to this crisis, there is the potential for a meaningful market recovery.

The Western world has moved to strengthen security alliances further, reduce dependence on Russian energy and continues to fight via economic sanctions. While the direct impact on US companies and markets is likely to be contained if this conflict remains a non-nuclear, non-NATO conflict, the much greater risk of broader, potentially nuclear war, and Putin’s instability, will remain a market overhang. Individual companies may face additional supply chain disruptions and revenue lost as they discontinue operations in Russia and European operations are disrupted. Consumers are likely to face higher prices at the pump, as curtailed supply has spiked prices. Inflation may accelerate further, increasing the likelihood of faster-than-expected rate increases and the risk that the rate increases slow growth. And all eyes are on China, the other major world power, for how they will navigate this conflict and future relations with the US.

As ever, investing remains a long-term commitment, particularly during times of turmoil and disruption. While hard on the nerves, it’s crucial to stay calm and stay invested, thoughtfully weighing information and assessing risk. We’re blessed to have the opportunity to invest and a stable US economic and financial environment to do so; here is hoping the Ukrainians have the same soon.

Disclosure: The information contained herein is based on sources that are believed to be reliable. Any statements nonfactual in nature herein constitute only current opinions or estimates, represent only the current judgment of the author, and are subject to change without notice.

[1] https://www.nato.int/cps/en/natohq/declassified_139339.htm

[2] https://www.npr.org/2022/02/12/1080205477/history-ukraine-russia

[3] https://carnegieendowment.org/2012/03/09/underachiever-ukraine-s-economy-since-1991-pub-474

[4] https://www.nytimes.com/article/russia-ukraine-nato-europe.html