In the Loop: April 2022

The first quarter of 2022 has been an eventful one, as rapidly rising inflation, the prospect of faster than expected Fed tightening, and the invasion of Ukraine by Russia caused high levels of market volatility. There was nowhere for investors to hide as the equity markets fell into correction territory and the bond markets broadly sold off. As the quarter closed, the S&P 500 index had recovered, however still finished the quarter -5%. The tech-centric Nasdaq index fell nearly -9%, and the Dow Jones Industrial Average was -4%. The Bloomberg Barclays US Aggregate Bond Index fell -5.9% in the quarter. Drowned out by the doom-and-gloom news cycle, there were positive market trends of note in the quarter as well. While it’s still early, we may be emerging from the Covid-19 pandemic, as infection rates and hospitalizations have plunged across the country. Mask requirements and other restrictions are being dropped, and March Madness saw arenas full of college basketball fans for the first time in years; Hawaii, with its strict Covid requirements, became the last state to drop its mask mandate, and the mask mandate on air travel may be dropped April 18. As well, the labor market remains strong, with low unemployment and a high level of job openings, and the consumer is in a strong position, with substantial savings on sideline. Corporations remain in solid shape. These positive market drivers are counterbalanced with high market risk factors, and as a result we are likely to have significant market volatility throughout the year.

Since the Global Financial Crisis of 2008-2009, we have had a long bull market, boosted by high levels of monetary policy liquidity. It has been such a long uptrend that the sudden correction in Q1 22 rattled market participants long used to stocks simply going up. Q1 2022 was a harsh reminder that markets go down as well, in some cases significantly and rapidly, and are fundamentally volatile. While normal market behavior, to many the downdraft seemed particularly jarring. It is probable that more volatility is still to come.

In 2021, as the economy and markets had largely recovered after the financial crisis and Covid-19 pandemic shock, the Fed announced that it would pull back its support of the markets and initiate a cycle of rate increases. Initially the Fed had begun to reduce its support as the economy and markets had shown a strong recovery both from the financial crisis of 2008-2009 and from the March 2020 Covid crisis. However, inflation began to rise rapidly, and the Fed is pivoting to a more aggressive stance to control price levels. This abrupt shift caused disruption in the bond markets, with US Treasuries down nearly -6% and investment grade bonds down over -7% in the first quarter.

We’ve all felt the sticker shock at the pump and at the grocery store, and concerns about inflation have risen. Predicting the future course of inflation is particularly challenging right now as there are temporary factors driving higher price levels. Global supply chain disruptions from Covid-19 persist, particularly as China has reimposed lockdowns in key manufacturing areas. The conflict in Ukraine and additional sanctions on Russia caused energy and commodity prices to soar. Easy monetary policy has also contributed to inflation. However, there are longer-term factors driving inflation as well, including the tightness in the labor market. It is a particularly difficult time to attempt to control rising inflation, and the Fed may overcorrect, raising rates too rapidly and risking a recession. Optimally, the Fed will would implement methodical, thoughtful rate rises which tame inflation over time without derailing the economic growth path the US is on.

Geopolitical risk increased markedly in the quarter with the Russian invasion of Ukraine in February. The invasion was not the easy victory Russia seems to have expected, and its increasingly brutal tactics and changes in strategy indicate that the invasion is not going as they planned. With significant troop losses and no clear exit plan, the outcome of the conflict is unclear. A protracted conflict in the Ukraine could become the new status quo, creating persistent instability in Europe. The invasion could escalate or, less likely, Putin could withdraw. A negotiated outcome is not helpful at this juncture, as the world no longer trusts Putin’s Russia. And, while less central to the daily flow of news, China, once the world’s growth engine, is strained by Covid breakouts and a property crisis. Its role in a world order with a more strongly united West and an aggressive Russia remains undefined. A more pro-Russian China could create a much more dangerous world; this has not been China’s path thus far.

It’s important to remain balanced when assessing the current situation and outlook, and there are several positive market drivers of note, including the potential evolution of Covid-19 to an endemic illness in the US, a strong labor market, strong savings levels and the likelihood of solid corporate earnings growth. While it’s too early to call a victory in the Covid-19 pandemic, particularly with the threat of new variants, infections and cases have dropped across the US and restrictions on day-to-day life have eased. A cautious back-to-normal could gradually occur over the next several months, with more employees returning to work, potentially in more hybrid situations, and travel increasing.

The labor market continues to be strong, with strong job gains, low unemployment and rising wages. Over 90% of the jobs lost at the peak of the pandemic have been recovered.[1] Consumer sentiment, after weakening in February, improved in March[2]. According to a study done by the Brookings Institution, approximately $2.5trn of excess savings accrued to consumers from March 2020 to January 2022, the bulk of which is sitting in bank checking and savings accounts.[3] Consumer spending is a key economic growth driver, comprising ~70% of US GDP. Finally, companies remain in a strong position, with record profit margins and solid long-term growth outlooks despite cost pressures and continuing Covid-19 supply chain challenges. For the full year 2022, S&P earnings estimates are expected to increase nearly 10%[4] vs 2021.

Looking ahead, we believe the rest of 2022 is likely to remain volatile, with a wide range of potential outcomes. There are numerous positive factors supporting the markets, including a strong underlying economy and US consumer, solid corporate earnings growth, and a potential return to normal in the U.S. as the Covid-19 restrictions ease. In addition, as we move towards November’s midterm elections, while political “noise” will increase, should Republicans pick up Congressional seats there is the potential for gridlock, often favorable for markets. However, risk factors are also high. Rising inflation and interest rates in the U.S. will continue be disruptive and cause volatility. In the Ukraine, the threat of an escalated conflict, or a protracted conflict, is rising as Russia did not see a quick victory and has seen high losses. Energy and commodity markets remain dislocated, driving further inflation.

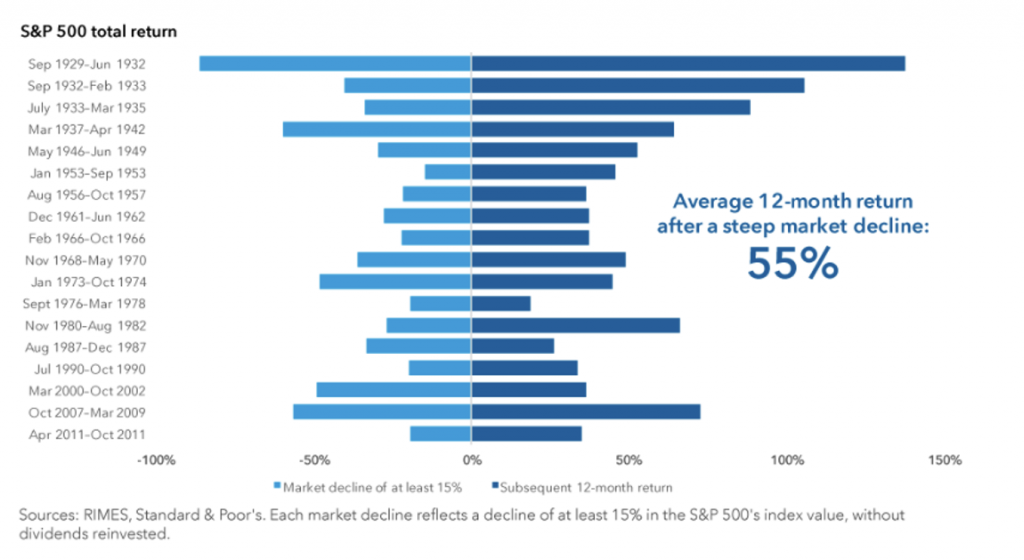

Investing in securities requires that some risk is taken. Financial markets are fundamentally characterized by volatility. Market pullbacks are a part of investing – according to RIMES and Standard & Poor’s data, pullbacks of -5% or more occur about 3 times a year, -10% or more once and year, -15% about once every 3.5 years, and -20% about once every 6.3 years[5]. After these pullbacks, markets have shown resilience and bounced back relatively quickly.

Given the rapidly shifting and volatile markets, it remains imperative to focus on the long-term. Market volatility, while uncomfortable, can create opportunities to buy attractive companies at bargain prices. Remember that the media can exaggerate fear and uncertainty with the aim of capturing your attention and driving clicks and advertising dollars, not necessarily with the aim of educating you. Putting down the phone or turning off the TV can be helpful.

In the meantime, Ukrainians face one of the world’s strongest militaries with determination, courage and valor. Many have been forced to flee. Those remaining, both civilian and military, face death or injury in dire circumstances. As Ukraine fights for its freedom and democracy, let us be thankful for the peace, freedom and prosperity we have here in the US and be grateful for the opportunity to invest.

Disclosure: The information contained herein is based on sources that are believed to be reliable. Any statements nonfactual in nature herein constitute only current opinions or estimates, represent only the current judgment of the author, and are subject to change without notice.

[1] https://www.nytimes.com/live/2022/04/01/business/march-2022-jobs-report

[2] https://www.conference-board.org/topics/consumer-confidence

[3] https://www.brookings.edu/research/bolstered-balance-sheets-assessing-household-finances-since-2019/

[4] Factset Q1 Earnings Insight, April 8, 2022

[5] https://www.capitalgroup.com/advisor/ca/en/insights/content/articles/6-charts-that-explain-market-declines.html