After a challenging 2022, 2023 got off to a good start in the markets. The equity markets saw strong gains in January as market participants anticipated a potential soft-landing scenario and no recession, despite the Fed’s rapid monetary policy tightening over the past year. However, as Q1 progressed, it became evident that the rapid interest rate increases had caused significant damage in the banking sector. Market volatility increased and investor fear about the overall stability of the financial system escalated rapidly. Quick action by the FDIC and the Federal Reserve helped improve public confidence and restore liquidity to the markets, and some order was restored as we moved through March. Today, issues continue to linger in the financial system, but for now investor focus has returned to inflation, the future path of Fed policy, and the potential for a recession. There is now some optimism around the potential for this tightening cycle to be near its end.

Consequences of Tighter Fed Policy Emerge: While the market environment feels better than it did in February and early March, we are not out of the woods yet. After a long period of unprecedented easing of monetary policy and liquidity support, the Fed began to tighten monetary policy in 2021 by withdrawing extra liquidity it had provided to the markets and by raising interest rates. This policy tightening accelerated as inflation accelerated in 2022. As monetary policy is imprecise and works with a lag, it has been months before the real effects of these actions have emerged.

The obvious risk of the Fed’s rapid tightening was a recession, and the focus of the market had been on anticipating how severe the potential slowdown or contraction in growth would be. The market was taken off guard by the negative impact the rate increase had on the balance sheets of financial institutions. Deposits had flooded into banks in 2021 and 2002, which then invested into securities. In some cases, banks had a mismatch between longer-dated assets (bond holdings) and short-term liabilities (deposits), which was done in part to generate additional investment return as the interest rate environment was so low. As rates spiked this past year, the value of those bonds held by banks as assets plummeted, as prices for bonds moved inversely to interest rates. Banks suddenly had significant amounts of unrealized losses on their balance sheets, which caused their capital cushions of banks to deteriorate. Banks like Silicon Valley Bank, Signature Bank and Silvergate Capital, with a high percentage of uninsured depositors and a concentrated client base, were particularly vulnerable to bank run. This was a deadly combination of risky management and a rapid loss of customer confidence and resulted in failure. The financial contagion spread to banks in similar positions.

Volatility is likely to continue as we continue to move through 2023 as the financial sector continues to shore up their capital positions. Other types of interest-rate sensitive companies, such as life insurance, face similar challenges. Leveraged companies with high levels of floating rate debt face higher interest costs and defaults could rise. Private assets could see meaningful valuation adjustments over time. Optimally, this next phase could be more of a slow-motion adjustment to the financial markets as these issues are worked through methodically.

Financial System Challenges Will Slow the Economy: The financial system shake-out is expected to reduce the availability of credit and will likely have the effect of dampening economic growth. While creating instability was not the Fed’s goal, it may be that the Fed is willing to tolerate some debt and equity losses (not customer deposits) at poorly managed banks to achieve the broader goal of bringing down inflation. This is a high-risk strategy, but may mean that, despite continued economic growth and relative strength in the labor markets, the tightening cycle is closer to a peak.

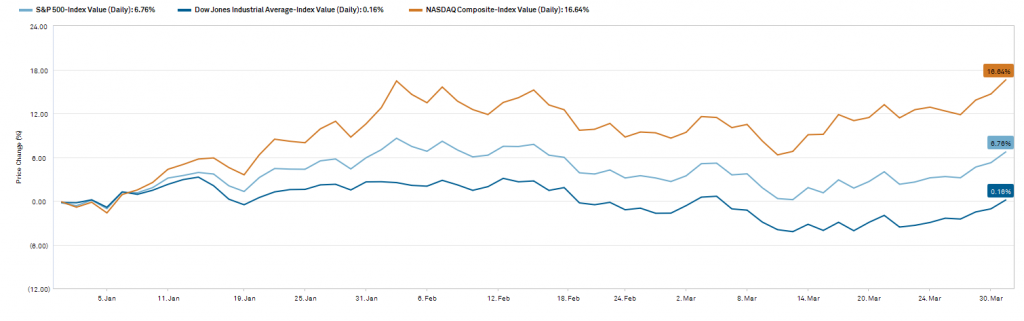

Market Returns Year-to-date Show Return of Risk Appetite: Investment returns have bounced from 2022’s sell-off, and the higher-risk NASDAQ index is up nearly 17% year-to-date, the S&P 500 Index is up nearly 7% and the mature, stodgier Dow Jones Index is flat. Some of the lowest quality areas of the markets have seen the highest returns, an indicator that risk appetite has returned to the market and expectations are for monetary policy to ease.

Outlook – Proceed with Caution: The odds of a recessionary period later in the year remain elevated and we are likely to see higher volatility as the financial system works through its capital issues. Corporate earnings will likely weaken as the year progresses. On a positive note, the U.S. economy has proven resilient, posting persistent growth despite the rate increases, and we may still have a soft landing, with inflation slowly brought under control without tipping the economy into a recession.

There remains a wide range of outcomes in the economic and financial markets as we look forward, particularly in the short term. As always, owning a diversified portfolio of high-quality securities bought at bargain prices is the key to building wealth over the long term. Volatility is unsettling, but amidst the chaos there can be great opportunities as prices overshoot on both the upside and the downside.

This publication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes.