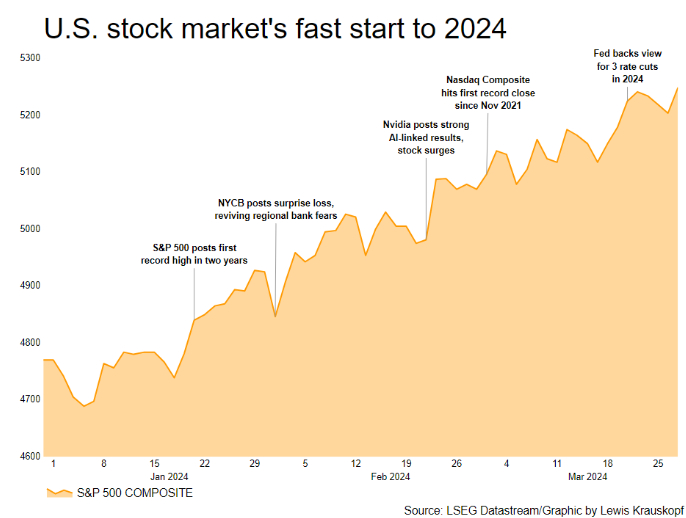

The U.S. stock markets hit record high levels in the first quarter of 2024, as continued economic strength, the potential for market-boosting interest rate cuts later this year and investor exuberance around the potential for artificial intelligence drove U.S. equities higher.

The S&P 500 Index, a market-capitalization weighted index which tracks 500 leading U.S. companies, increased nearly 10% in the first quarter of 2024, hitting record highs. The NASDAQ Index, which tracks stocks listed on the NASDAQ and tends to be tech company-heavy, was up over 9%. Even the Dow Jones Industrial Average, which tracks 30 mature, strong companies, was up nearly 6% in the first quarter. This strong performance followed double-digit investment in the equity markets in 2023.

Q1 2024: Economic Strength and Expectations for Interest Rate Cuts Continue to Drive Major Rally

The markets continue to be predominantly driven by macro factors. Market participants have been comforted by the very soft landing we’ve had so far this year, where we have seen strong economic growth and continued consumer spending, despite rapid and significant monetary policy tightening. Typically rapid increases in the Fed Funds short-term interest rate causes a slowdown, weakness in the labor market and the risk of recession. The equity markets have shrugged off this concern, and have continued to assume that the economy will grow and the negative impact of the rate increases will be limited.

This year we will continue to be “Fed watchers”. Market expectations for timing and size of interest rate cuts in 2024 continue to shift. While some projections called for as many as 6-7 rate cuts earlier this year, now expectations are for 2-3 cuts, as inflation has remained persistently higher than expected. Either way, markets tend to be buoyed by rate cuts, hence the equity market strength thus far into 2024.

Artificial Intelligence Continues to Drive Investor Exuberance

The introduction of ChatGPT and generative AI created quite a bit of excitement. Companies are in the early stages of understanding how this new technology can drive improved efficiency and productivity and what new products and services and markets can be created with this new technology. In the meantime market participants have jumped on the proverbial bandwagon, and equity prices for companies with AI exposure have risen dramatically. The key question for market participants is whether those elevated valuations are justified.

Risks Remain in the Funding Markets

Quantitative Tightening: We are not in the clear yet, however, and significant risks remain. While the equity markets have focused on the potential for rate cuts, market participants have largely ignored the potential impact of a continued program of monetary policy tightening. Since June 2022, the Fed has simply been allowing the bonds it owns to mature without repurchasing additional bonds. $95bn of these bonds roll off monthly, and the Fed’s balance sheet is shrinking quickly. This quantitative tightening (“QT”) has the potential to disrupt the short-term repo market, a key market for overnight liquidity, and other funding markets. As well, if QT continues at its current pace bank reserves could shrink, as would the availability of credit. This could cause an economic slowdown or recession. How the Fed manages this program is important to track in the upcoming months.

Inverted Yield Curve: The yield curve, which graphs U.S. Treasuries by their maturity, remains inverted, meaning that the yields on short-dated Treasuries are higher than Treasuries with longer durations. Typically this has been an indicator of a looming recession, as in normal conditions investors demand more yield the longer a security is outstanding. With an inversion, investors are paying more for the safety of the short term.

Uncertain Future Path of Key Benchmark Rate: 10-year U.S. Treasury note is a key benchmark for mortgage rates and other key interest rates in the economy, and despite the discussion about rate cuts for shorter-term securities, the 10-year rate remains elevated and closed Q1 at ~4.2%. There is quite a bit of disagreement as to the future path of this key benchmark security. Some market participants are highly concerned that the large and growing U.S. deficit will require more issuance of U.S. Treasuries to fund it, ultimately causing higher yields as investors will demand more to hold U.S. debt. Strong economic growth may cause rates to remain elevated as well. However, if inflation moves downward, sustainably, there is the potential for a lower 10-year Treasury yield. This uncertainty has the potential to create volatility.

Outlook

There is still a wide range of outcomes for the rest of 2024, and political “noise” will increase as we move toward U.S. Presidential elections in November. While risks remain, particularly in the debt markets, consumers and companies are healthy. Valuations have become extended in some areas, however pockets of opportunity remain. As always, having a long-term view and remaining invested through the market cycles in a balanced, diversified portfolio of high-quality securities remain the keys to building long-term wealth. Taking profits will continue to feature in portfolio management. And should we have a near-term period of correction, know that it is a normal part of the market cycle and corrections provide good opportunities for investment.

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.