Q1 2025 and the First Few Weeks of April: Own Goal?

2025 began on a strong footing. In 2024 U.S. stock markets had hit record high levels, driven by economic strength, healthy consumer spending, strong corporate profits and short-term interest rate cuts by the Federal Reserve. Investors were optimistic coming into the new year, buoyed by the prospect of more interest rate cuts by the Federal Reserve (“Fed”). Investors also hoped that the incoming Trump administration would bring deregulation, market-friendly policies and more growth. However, market sentiment in the first quarter of 2025 quickly shifted to the negative. The markets are no longer focused on the Fed. Now, the Trump administration’s policymaking has taken the spotlight.

Throughout the quarter, threats of a trade war, the DOGE initiative led by Elon Musk and the relentless barrage of new policy announcements rattled investors. Many executive orders prompted major changes. The announcements came at a breakneck pace, appeared impulsive and reckless, and were subject to change at a moment’s notice.

This uncertainty impacted business confidence. Leaders held off major strategic decisions, waiting for some clarity. Consumer confidence was also negatively impacted. Unsettled investors also began to consider the prospect of higher inflation and slowing growth, and at worst, a recession or stagflation. Excitement about potential rate cuts fizzled quickly.

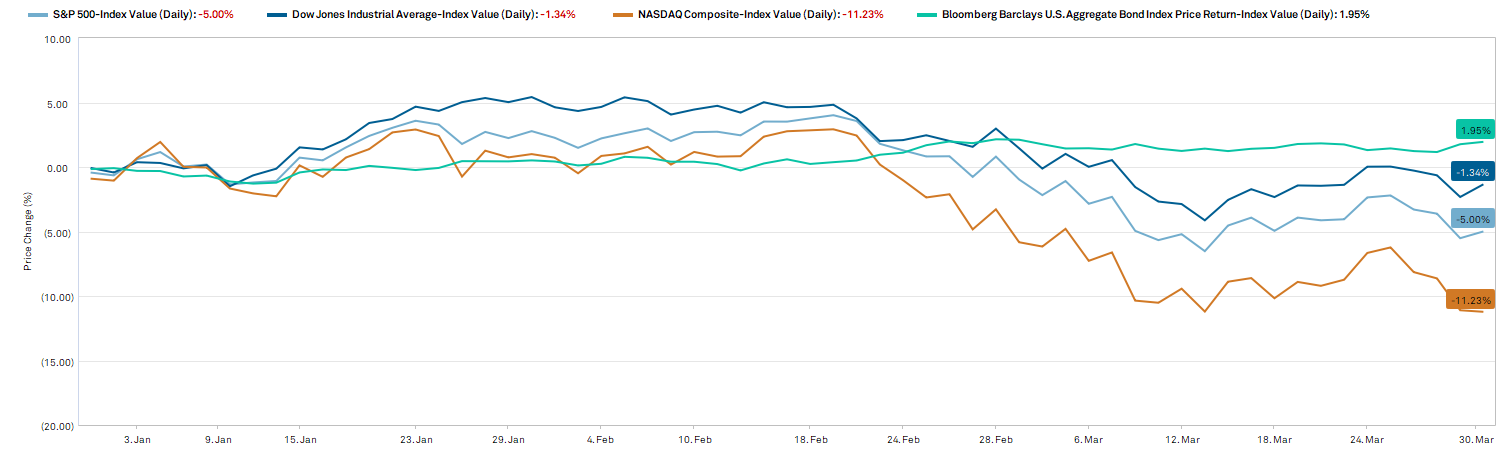

For the quarter ending March 31, 2025, the S&P 500 Index, a market-capitalization weighted index which tracks 500 leading U.S. companies, ended down over -5%. The NASDAQ Index, which tracks stocks listed on the NASDAQ and tends to be tech company-heavy, was in correction territory, dropped over 11%. The Dow Jones Industrial Average, which tracks 30 mature, strong companies, was down 1% in the first quarter. The fixed income markets had a better quarter, and the Barclays U.S. Aggregate Bond Index was up nearly 2%.

Tariff Policy Announced Early April Sparks a Sell-off in U.S. Assets

Since the end of the quarter, however, the lack of certainty has worsened. In response to Trump’s announcement of “Liberation Day” on April 2, financial markets dropped precipitously. After weeks of discussions and threats, the President unveiled a highly punitive, simplistic tariff regime which applied to trading partners worldwide.

Financial markets, which had assumed Trump was only blustering to position better for deal-making, were taken off guard by the concrete announcement. Equity markets sold off rapidly intraday. It is concerning that U.S. Treasuries, typically a safe haven for investors, also saw signs of weakness. Yields on U.S. Treasury debt (specifically, the 10-year US Treasury Bond) went higher as investors sold U.S. Treasuries (as prices drop when investors sell bonds, the yields on those bonds move higher). The U.S. dollar, also thought to be a safe haven as the world’s reserve currency, weakened. Typically, in times of market turmoil, investors seek shelter in U.S. Treasuries and the U.S. dollar strengthens. That did not happen in this period of turbulence.

Announcement of Pause Causes Relief Rally, Escalates Trade War with China

China promptly punched back with its own major tariffs on U.S. goods, which caused markets to drop further. It was only when the bond market appeared to be at the breaking point on April 9th that Trump announced a 90-day halt to all but China’s tariffs, and imposed even higher tariffs on China.

The tariff policy “pause” announcement caused a massive market rally, but it is only a pause, and the trade war with China has escalated. It is unclear what happens after 90 days, and it is also unclear what happens with China.

Outlook: We’re on a Knife-Edge. Avoiding an Own Goal

After the tariff policy announcement and market reaction, the risk of a recession has elevated as confidence in the future has been negatively impacted. Even worse, the prospect of stagflation, the combination of higher inflation and slow or negative growth, has begun to creep into future market scenarios as sentiment has turned negative. The Fed, faced with the unprecedented challenge of potentially guiding our financial system through a self-inflicted crisis, has explicitly said that it will remain on the sidelines so that it can monitor data.

It feels like a knife-edge: the U.S. economy could prove resilient and shake this off, and potentially grow more, bolstered by positive tax and growth legislation contained in the tax bill working through Congress. On the other hand, we could easily tip into a negative spiral, where consumers face higher and higher prices or scarcity of products. The labor market may worsen, particularly if companies lay off employees to defend their profit margins. Either way, it is likely that participants in the economy will effectively go into a pause mode and will wait for the uncertainty to resolve before making major investments.

Will this trade war mess end up being an own goal, where we score on ourselves and lose the game? Again, we started the year in a strong position and now are in tense stand-offs with some of our closest trading partners, like Canada and Mexico, and have escalated tensions with adversaries. Will the revenue raised be enough to get the Trump administration’s legislation through Congress (one of the reasons the tariffs may have been imposed) without doing catastrophic damage? Or has the damage to the “U.S. brand” been done, and it’s a foregone conclusion that we’ll go into recession? April’s data will tell a clearer story. These are unusual, highly uncertain times.

As always, a balanced, diversified portfolio of high-quality securities and a long-term investment horizon remain the keys to building long-term wealth. Short-term reactions can often result in negative unintended consequences. Corrections, self-inflicted or not, are part of the market cycles and corrections provide good opportunities for investment.

Use of any information presented is for general information only and does not represent individualized tax advice, either express or implied. You are encouraged to seek professional tax advice for questions and assistance.

Lariat Wealth Management is a registered investment adviser offering advisory services in the State of Colorado and other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.