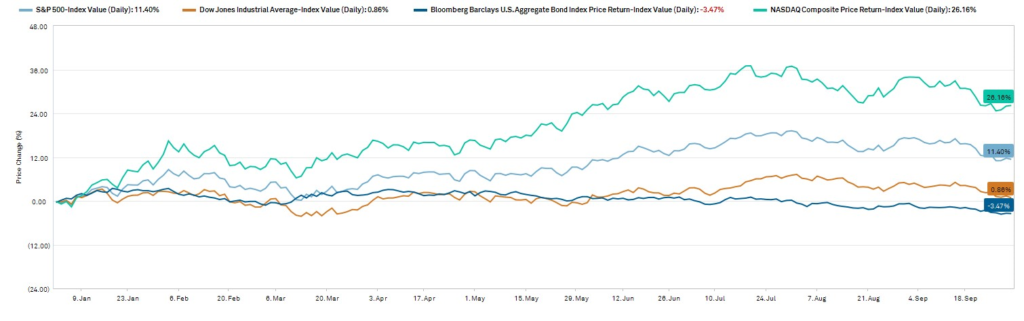

Q3 2023 Review: Bond Market Volatility Rises, Equity Markets Weaken but Still Strong YTD

After a strong first half of 2023 in the financial markets this year, sentiment in both the equity and bond markets began to worsen early in the third quarter. Typically, July and August are quieter months in the markets, as many market participants take time off. Market activity and volatility often picks up in the fall. This year this activity picked up a bit earlier, with sentiment turning negative across the financial markets at the end of July. While investment returns for the S&P Index and Nasdaq stock market indices remain strong year-to-date, these indices, as well as the Dow Jones Industrial Average and the Barclays Aggregate Bond Index, declined 3-4% in the third quarter. This rapid shift in sentiment was due to several factors: adjusted expectations that the Fed will hold short-term rates higher for a longer period of time, bond market turbulence and a rapid rise in U.S. Treasury yields, political and geopolitical instability, and the continued concern that a recession may be imminent.

Major Stock and Bond Index Performance – Year-to-date

Monetary Policy Remains the #1 Issue in the Markets: With the goal of bringing inflation back under control, the Fed has tightened monetary policy conditions quickly over the last 18+ months. This type of policy tightening is intended to slow the economy and bring price levels back under control. The “normal” reaction to tightening monetary policy is for labor and housing markets to slow, consumer confidence and spending to weaken and for credit conditions to tighten. This causes economic growth to slow and potentially turn negative and slip into a recession. This time is different, however. The rapid and extreme tightening measures have had a muted effect. While there has been some fallout, including the failures of several major banks in February and March this year, the economy has remained resilient. Market participants began to believe that a soft landing, or tightening cycle without a recession, was possible.

New Market Expectations: Rates to Stay Higher for Longer: The Federal Reserve held its annual meeting of central bank monetary policy makers in Jackson Hole, Wyoming, this August. Fed Chairman Jerome Powell noted that the economy was not cooling as much as anticipated, and left the door open for additional rate hikes. The Fed has raised rates 11 times since early 2022, and the current target Fed Funds rate is 5.25-5.5%. Market expectations shifted from a quick, soft landing and potential rate cuts early 2024, to the expectation that the Fed will raise once more in 2023 and then pause, keeping rates higher for the duration of 2024. The markets sold off on this negative development.

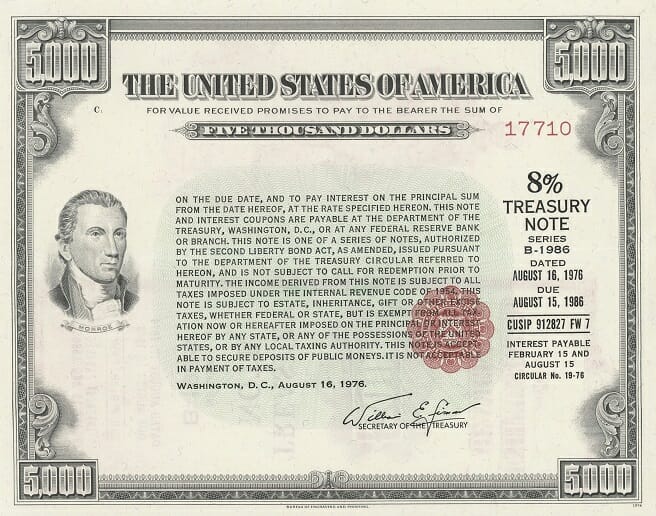

Rapid Rise in 10-year U.S. Treasury Yields: This quarter was particularly interesting in the bond markets. The yield on the 10-year U.S. Treasury Note, a key benchmark bond for U.S. debt, rose to 4.8% in early October, up ~150bps from lows earlier this year and hit the highest levels since 2007. This was due to several factors, including increased concern over our large U.S. budget deficit, U.S. political instability, geopolitical dynamics and a pullback of overseas investor demand. The 30-year U.S. Treasury yield surged in a similar way.

Government Debt

When yields increase, the value of bonds declines. Companies or individuals who hold these bonds face a loss, at least on paper. This may have negative repercussions and cause pockets of market instability, like capitalization issues we observed at banks earlier this year.

Silver Lining: the Bond Market Appears to be Returning to Normal: Despite the rapid increase recently, current 10-year yields are still below the long-term average yield of 5.2% (see chart below). As well, real (ie, inflation-adjusted) returns are positive and much more meaningful than they have been in over a decade. As the overall market stabilizes at higher rates, the role of bonds in portfolios as income generation and ‘cushion’ to equity volatility should be much more dependable. While the adjustment may have painful moments, moving away from the artificially low interest rate environment of the last 11 years and back to a more normal environment is a significant positive.

Source: Federal Reserve, Robert Shiller/Yale University, Focuspoint Solutions calculations, period ending 9/30/23

Outlook: Large Range of Outcomes with Pockets of Risk, Pockets of Opportunity: Looking ahead, there is the potential for further challenges in the markets. Inflation remains sticky, with a structurally strong labor market. Even if the inflation rate declines, it’s unclear if it will decline enough to cause the Fed to reverse course. Political and geopolitical instability has increased. Fallout from recent yield surges could surprise the market, and a recession is still a real possibility, despite the continuing resilience of housing and the consumer.

However, there are real positives: the CHIPS and IRA Acts will create investment opportunities as substantial funding is directed to specific industries. Company fundamentals remain stable. And unusually, short-term, low risk products, such as cash products and U.S. T-Bills, are offering attractive rates. Managing risk with diversified portfolios, while taking advantage of market opportunities, remains key to success.

Lariat Wealth Management is not soliciting any action based on this material. It is for the informational purposes only. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested.