In the Loop: June 2022

Two months ago, I wrote about navigating the market’s “rapids”, as we had begun 2022 with high levels of market volatility. I’ll continue the theme this month, this time with roller coasters, as the markets continued to be tumultuous through May. I grew up in Williamsburg, Virginia, and one of the places to go in the summertime, besides the historic area, was Busch Gardens. 30+ years ago (!) the major attraction was the Loch Ness Monster roller coaster, which featured two interlocking loops, which was exciting back then. Roller coasters are much more fun than volatile markets, and the reason I’ve highlighted the Loch Ness Monster and roller coasters is to make the simple point that while there can be major, rapid, scary drops in the market, there are slow climbs, rapid climbs, and plateaus as well. And roller coasters typically get you back to the beginning of the ride safely. As with roller coasters, in the financial markets there are no guarantees. However, over the long term the U.S. equity markets have generated positive long-term returns, albeit with some big drops along the way. There’s no shortcut to investing. You must endure the ups, downs, and rapid descents over the long term, and you can’t hop off the roller coaster in the middle of the ride and expect a successful outcome.

May 2022 was another roller coaster month in the markets. The same disruptive market themes which have persisted throughout the year also whipsawed the markets in May. Rapidly rising inflation has caused concern about the prospect of the Fed raising rates by a significant amount quickly, risking a recession or stagflation. We’re starting to hear of the personal impact of inflation on consumer behavior, and high gas and grocery prices have started to become a political lightning rod as we move into midterm election season. Large retail companies have reported bloated inventory levels as they misgauged consumer demand, and company finance directors expect a recession in early 2023[1]. As well, the continuing attack on the Ukraine has resulted in geopolitical instability and commodity price spikes.

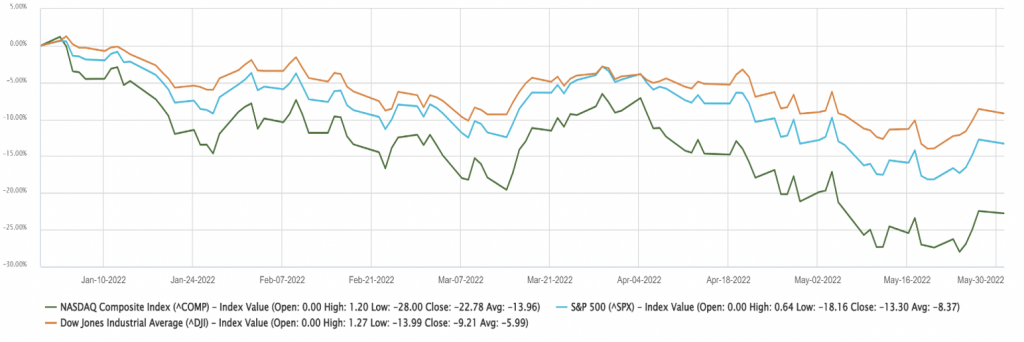

The month began with a rapid drop in the equity markets, with the S&P 500 nearing bear market territory. However, a month-end rally pulled the S&P 500 up to close May out roughly flat. Year-to-date, the S&P 500 recovered from down nearly -20% on May 20th to recover and finish the month with a year-to-date return of -13%. The Dow Jones Industrial Average, comprised of more mature companies, was up slightly for the month of May and is down -9% year-to-date, and the tech-heavy NASDAQ index was down -3% in May and -23% YTD, after being down nearly 30% at the market lows.

The market remains laser-focused on the Fed. Recall that the Fed had announced last year that it would remove some of the excess liquidity it provided to the markets during the Covid-caused market crash in March 2020, would contract its balance sheet and begin to raise short-term interest rates to a more normal level. While this alone created volatility, it was largely positive as the Fed’s actions were the result of a much-improved economy and financial markets which had stabilized and boomed.

Today, however, stubbornly high inflation has thrown a spoke in the wheel of the Fed’s policy response. The market has lost confidence that the Fed will successfully tame high inflation without rapidly raising rates and potentially pushing the economy into recession. Bringing inflation back under control is not an easy task for the Fed, which faces several challenges. First, it must correctly assess what is causing inflation as today’s high inflation has been caused by both long-term, “sticky” factors and short-term “transitory” factors, and include an extremely tight labor market, pandemic-related supply chain disruptions, commodity price dislocations exacerbated by the invasion of the Ukraine by Russia, and a tight housing market. The Fed must assess what ‘real’ long-term inflation is, after the transitory drivers fade, how long will that take, and how much and how rapidly rates should be increased in response. Second, the Fed must withdraw liquidity from the markets and raise interest rates while not derailing economic growth. Should the Fed slam on the brakes, or raise rates too high or too quickly, it runs the risk of causing a recession and at worst, stagflation, a combination of low or negative growth and inflation.

Today’s markets are tricky as there is a wide range of potential outcomes. We could have a scenario of stagflation or recession. Or, we could have a smooth glidepath scenario where the Fed is successful, rates continue to normalize and economic growth persists, potentially at a lower but still healthy rate.

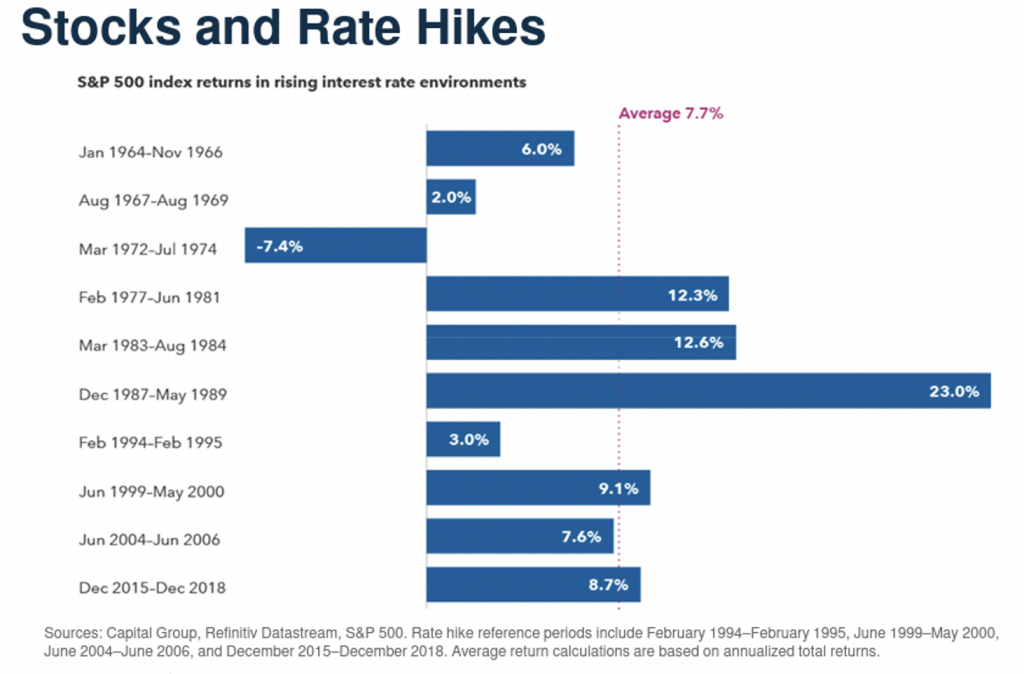

Either way, rates are likely to rise, which has ripple effects throughout the economy. As mortgage rates rise, the housing market can slow. As cost of capital for companies increases (i.e., what they’re able to borrow for), debt-funded growth will slow. Highly leveraged companies with floating rate debt can run into trouble if they’re not able to pay interest on their loans. Consumers may face higher rates on credit cards, auto loans and other forms of consumer finance. When the discount rate rises, which is the rate used by market analysts to discount a company’s future cash flows, a company’s cash flows are worth less, which is driving the contraction in the equity markets. Companies with expectations of cash flows way into the future, for example riskier tech companies with no current earnings, have been especially hard-hit, as they’re worth much less as discount rates adjust upwards. The era of easy returns and the buy-anything-and-make-money era in the stock market, which we’ve been a beneficiary of for over a decade, is likely over. As well, investor funds which were shifted to equities given the extremely low fixed income returns are shifting back, putting further pressure on near-term equity market returns. However, rising rates are not all bad. We’ve been in an environment of artificially low rates, which has distorted price signals, incented risk-taking and has had the potential to create asset bubbles. Rising rates are a positive for those needing income, including retirees, as returns on bonds and cash increase and normalize. As well, the equity returns can be positive in rate-hike cycles (chart below).

As with navigating rapids, the key in roller coasters is to hang on. Volatile markets can be great sources of investment opportunity. Enjoy your summer!

This publication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This publication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes.

[1] https://www.cnbc.com/2022/06/09/recession-will-hit-in-first-half-2023-the-dow-is-headed-lower-cfos.html?&qsearchterm=recession