Equity markets have surged back in 2023 after 2022’s precipitous decline. Driven largely by investor excitement over artificial intelligence, a few large companies have seen significant rebounds this year and have driven the S&P 500 Index and Nasdaq Composite equity indices higher. Adding to positive sentiment, a default on U.S. debt was averted at the end of May with a surprisingly undramatic bipartisan agreement to raise the debt ceiling. Continued economic resilience and increasing confidence that that the Fed may be nearly finished with raising interest rates have added to the favorable backdrop. While it’s a relief to many investors to have a strong uptick in market indices, it’s important to recognize that current market conditions are narrow and unstable. While there are real positives to our current investment environment, many market participants are overlooking warning signs. It is best to remain cautious as we move through 2023, and to anticipate future volatility so we’re best positioned to take advantage of it.

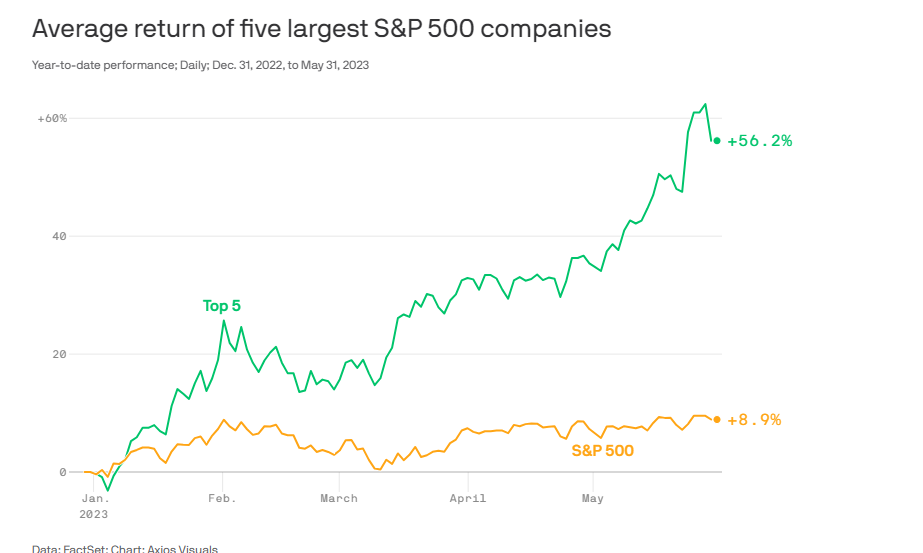

The introduction of ChatGPT, a generative-AI chatbot which generates content in response to a broad range of questions and the prediction by Nvidia CEO Jensen Huang in May (as he was introducing the company’s new AI superchip) that we are “entering a new computer era”[1], drove a recent investor stampede into AI-related stocks. Note that the strength in the market is not broad-based. A small group of megacap tech companies with AI exposure are driving returns year-to-date.

Source: https://www.axios.com/2023/06/01/sp500-tech-companies-stock-price

At the end of May, more tech-oriented equity market indices showed strong investment returns. The S&P Index, with 35% of its weight comprised of the top ten megacap tech companies [2], was up nearly 9%. The tech-oriented Nasdaq Composite was up 22%. The Dow Jones Industrial Index, made up of slower-growth, mature companies, was down nearly 1%. The Bloomberg Barclays U.S. Aggregate Bond Index eked out a 1% gain.

Source: S&P Capital IQ

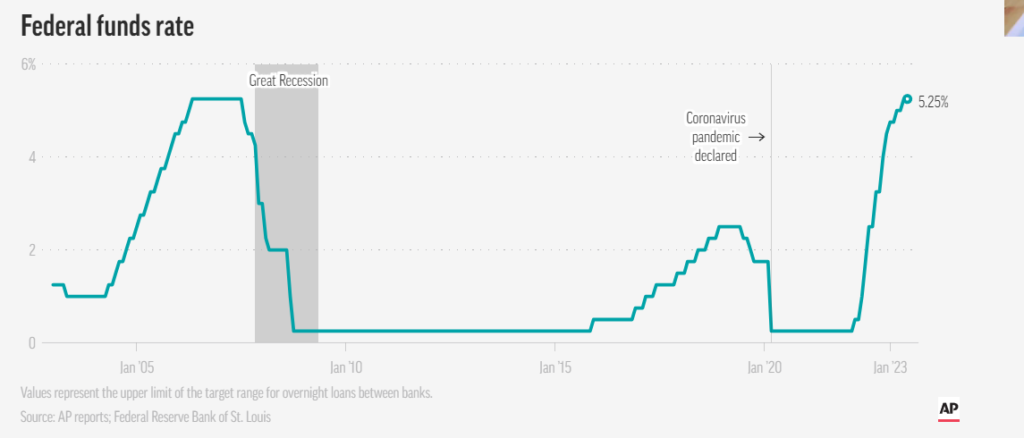

Investors have put concerns over the impact of the Fed’s rate increases, monetary policy tightening, financial system instability and risk of recession on the back burner. Since March 2022, the Fed has raised the Fed Funds target rate by 500 basis points, in a bid to control rapidly accelerating inflation. At its recent June meeting, the Fed currently paused rate increases and will continue to monitor the effect of the rate increases on inflation. It left the door open for further increases.

The Fed’s rapid interest rate increases have already caused financial system instability, as several large banks including Silicon Valley Bank have failed in recent months. Banks overall have begun to pull back on lending, which will likely slow the economy, and concerns about potential problems in commercial real estate loom on the horizon.

Numerous positives remain. Despite the fastest interest rate tightening pace in 40 years, the labor market has remained resilient. Consumer sentiment remains relatively strong, as inflation has decreased dramatically, from over 9% last year to 4% more recently. While still too high versus the Fed’s target inflation rate of 2%, the negative impact on individual pocketbooks has lessened. Geopolitical conflicts, including the Russian invasion of Ukraine and bilateral tensions with China, appear to be stable to improving.

The high level of market confidence combined with the risk of further Fed tightening, recession and high valuations of market-leading companies increase the likelihood of future financial market volatility and create risk for investment returns. Expectations for continued market strength may be overly optimistic, and the narrow market leadership may prove to be a wobbly stool.

As always, despite the clouds on the horizon, market volatility provides opportunities for investors. Current areas of focus include taking profits in strong performers which have reached high valuation levels while continuing to look for attractive new investments, including moving into more defensive and smaller-sized companies and income-generating assets trading at attractive valuations. We also continue to work understanding the less-obvious winners from artificial intelligence and its applications, as well as companies exposed to additional technological advances including quantum computing, synthetic biology and biotech advances, 6G, and potential beneficiaries of legislative initiatives (Chips Act, Inflation Reduction Act). Staying invested and continuously adding to investments through dollar-cost averaging remain the keys to building wealth for the long-term. While markets can feel reassuring at times, those times call for more caution as sentiment can change on a dime. A core element of successful investing is to anticipate bumps on the road while remaining focused on the long-term. That way, short-term volatility does not derail long-term success.

[1] https://www.cnbc.com/2023/05/30/everyone-is-a-programmer-with-generative-ai-nvidia-ceo-.html

[2] https://www.morganstanley.com/ideas/concentration-risk-high-s-and-p-500-q2-2023

This communication is for informational purposes only and should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes.