Volatile 3Q 2022 Features a Shortlived Bear Market Rally, But Silver Linings Emerging

We began the third quarter of 2022 on a positive note with an equity market rally through mid-August. This was a welcome development after the challenging start to 2022 but did not last, as rising interest rates and uncertainty regarding the direction of the economy created significant volatility through the rest of the quarter. Rising geopolitical tensions and negative news flow around midterm elections exacerbated the negative sentiment.

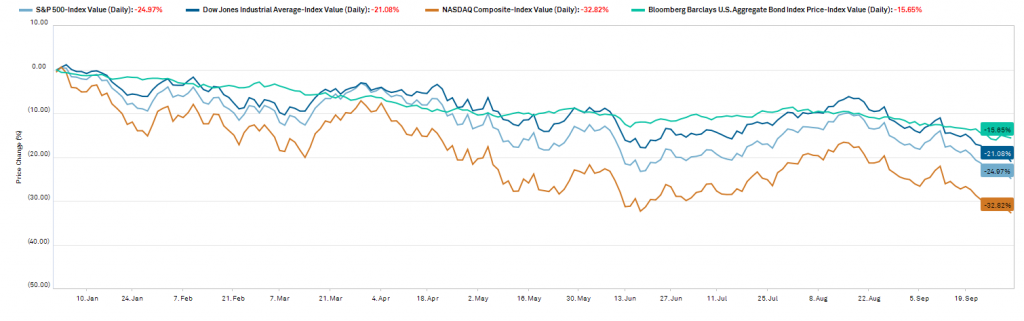

The equity markets finished the third quarter in bear market territory, with the S&P 500 down -25%, the tech-heavy Nasdaq index down nearly -33% and even the slow-growth, conservative Dow Jones Industrial Average Index down -21%. For similar reasons, the bond market has had one of the most challenging starts to a year in decades. The Bloomberg Barclays Aggregate Index was down over 15% through 3Q 2022. While short-term losses are considered a more normal risk of participating in the equity markets, significant losses in bonds, particularly higher quality securities, are not typical. The widespread nature of the losses in fixed income has also been unusual. Losses have occurred across all types of bonds including municipal bonds, inflation-protected bonds, and government bonds. 2022 has been unsettling and the volatility is likely to continue until inflation begins to slow.

What’s Driving Volatility: Inflation, Interest Rates and Economic Growth

Inflation is the broad-based increase in the prices for goods and services. Beginning in 2021, the rate of inflation began to increase to unsustainable levels and worsened throughout this year. According to data from the U.S. Department of Labor, as of August 31, 2022, the inflation rate was 8.3% for the trailing 12 months. Today’s inflationary environment is attributable to both monetary and fiscal policies instituted years ago to help the economy and markets recover from the Great Financial Crisis and the Covid-19 pandemic. The Federal Reserve’s monetary policy plus numerous fiscal relief packages in the form of direct grants and loans increased the liquidity available to purchase goods and services in the US economy. At the same time, goods and services available for sale were severely truncated due to Covid-19 factory closures and supply chain disruptions. Geopolitical conflicts, including Russia’s invasion of Ukraine and the increasing tension with China, worsened the situation and caused the price of key commodities, including energy and agricultural goods, to spike. In turn, the final price of goods made with these inputs increased as well.

This August, during the annual Jackson Hole meeting, Fed Chair Jerome Powell forcefully communicated that the Fed would do what it takes, including risk a recession, to bring inflation under control. This is effectively like pulling up the emergency brake on the highway when driving at 65mph. It may end without an accident, but the action is high-risk.

Outlook: More Volatility, With Some Silver Linings

What we are observing in the markets is a painful withdrawal of the market support and resulting adjustment, which thus far has not had the clear effect of slowing the economy and labor markets. More recently there has slight slowing, particularly in real estate. The labor market, which the Fed is intentionally trying to weaken, has continued to be strong. It’s an odd situation, as the Fed is intentionally trying to slow down the labor market and potentially increase unemployment to control wage growth, a key driver of inflation.

The steep decline in the equities markets is because interest rates are the key discounting factor applied to a company’s future cash flows when determining its worth in today’s dollars. A higher discount rate reduces the value of those cash flows. There was quite of bit of excess risk-taking in the markets over the past decade and we have seen a shake-out this year. Some of the profitless, low-quality companies are being marked down by the markets properly, but there are many companies with strong competitive moats which generate substantial free cash flow being thrown out with the proverbial bathwater. There are and will be great bargains – a key silver lining to the current environment.

In the bond markets, it’s likely that as soon as we near the end of the Fed tightening, the market will improve. Timing is uncertain. Note that this will occur as the economy worsens, sentiment worsens, and layoffs increase. The key silver lining in the bond market is that investors in cash and fixed income securities are finally receiving a yield on their investment, after over a decade of earning next-to-nothing. Many may feel distressed by the market moves this year, which is a normal reaction. This year’s poor performance, particularly in the bond markets has been called “extraordinary”[1] relative to long-term data. Remember that the Fed is intentionally trying to cause economic pain in order to slow inflation, and our situation will likely feel worse rather than better in the short-term. Note that there is a behavioral tendency to extrapolate out the current situation or assume that a bad situation will worsen further, without giving the same weight to the possibility that the situation could improve. Given the current level of negative sentiment, the markets could react quickly and positively to good news.

—

This publication is for informational purposes only and is not intended as tax, accounting or legal advice, or as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes.

[1] https://www.nytimes.com/2022/09/30/business/bonds-market.html