The Fed 101, Inflation, Tapering and What It Means to Investors

In response to the Covid-19 pandemic and resulting financial market disruption in early 2020, the Fed provided substantial monetary policy support to the US economy by lowering short-term interest rates and purchasing securities, primarily US Treasuries and mortgage bonds. This latter program was called “Quantitative Easing”, or “QE”. While there is debate around the unintended consequences of these policies, there is no question that they catalyzed a post-Covid-19 economic recovery in the US.

Because the economy is growing at a faster pace than expected, the Fed has signaled that it will be reducing its monetary support to the markets beginning as early as Fall 2021. The Fed is currently purchasing $120bn of securities a month under the Quantitative Easing program. It will begin to reduce those purchases over time, eventually phasing them out. Once that is complete, the Fed will have increased flexibility to raise interest rates from the current near-zero level.

These events have been well signaled and are expected by the market, and are a return to normal conditions from the emergency measures put into place during the crisis. Despite that, market volatility could increase as the markets adjust to a reduced level of external support from the Fed.

Similar to a boat captain being aware of weather, currents and obstacles before embarking on a voyage, understanding how the Fed works, the debate around interest rates, and “tapering” (which is the reduction of QE), will help significantly as we navigate the markets over the months to come.

Quick Fed 101: The “Fed”, short for the Federal Reserve System, is the central bank of the United States. The Fed has several key roles, most importantly the conduct of monetary policy in the US. In addition, the Fed is responsible for the oversight of financial institutions, financial system stability, ensuring safe and efficient payment and settlement systems in the U.S and consumer protection and community development. The Federal Reserve System was established in 1913 after a series of financial panics, bank failures and scarce credit[i].

The Fed has three key entities which carry out these mandates. The Federal Reserve Board of Governors is a 7-member board appointed by the President and confirmed by the Senate. The Board provides overall guidance to the Fed system and oversees the 12 Reserve Banks. In addition, there are 12 Federal Reserve “Districts”, represented by a Federal Reserve Bank. The third key entity in the system is the Federal Open Market Committee, or “FOMC”, which consists of the Board of Governors and the Presidents of the Federal Reserve Banks. The current Chairman of both the Reserve Board and the FOMC is Jerome Powell, who has had roles in banking, private equity, public service and academics. The FOMC was created in 1977 after a period of high inflation, and is the primary entity responsible for monetary policy-making in the U.S.

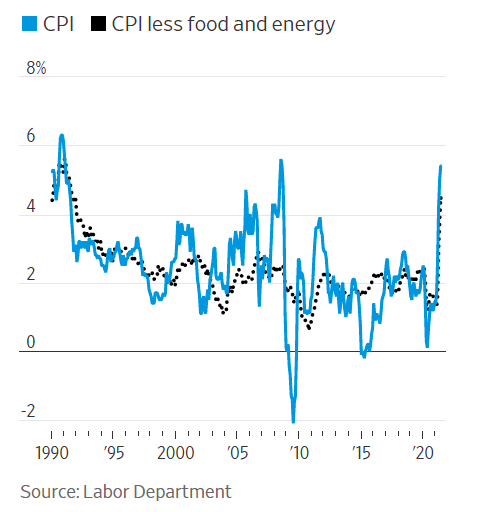

Monetary Policy – Sounds Boring But It’s Important! Monetary policy refers to what the Fed (or any central bank) does to influence the amount of money and credit in the economy[ii] . In the U.S., Congress requires the Fed to have a “dual mandate”, which means that its two primary monetary policy goals are to achieve maximum employment and stable prices (or, said another way, low inflation). Moderate long-term interest rates are a third goal of U.S. monetary policy. The specific targets for each have varied over time. Currently, maximum employment is assumed if there is a ~4% unemployment rate in the U.S., and the inflation target rate is ~2% average inflation over time.

The Fed utilizes a variety of tools to conduct monetary policy and increase or decrease the money supply. A primary tool of the Fed’s is using its borrowing and lending power to influence the “Fed Funds rate”, which is the rate financial institutions charge each other for overnight borrowing of reserves. In addition, the Fed uses bank reserve requirements and other policy tools.

Changes in the Fed Funds rate influence interest rates in the economy overall, impacting the cost of loans for consumers and for businesses in general, overall credit availability, employment conditions, and inflation. Typically, the Fed will conduct monetary policy to raise the Fed Funds rate to keep inflation in check (“tightening”), or it will decrease the Fed Funds rate to stimulate the economy and boost lending and employment (“accommodating”), particularly in times of crisis, such as the Global Financial Crisis in 2008-9 and the beginning of the Covid-19 pandemic in March 2020.

Two topics have the market’s attention with regard to interest rates:

1) how much “permanent” inflation we have in the market, and how much the Fed will raise interest rates in response, and

2) how volatile the return to normal will be (and what “normal” even looks like!), as the Fed slows and ultimately ends QE.

Less Quantitative Easing is Called “Tapering” – Slowly Taking Away the Punch Bowl: In response to both the Global Financial Crisis and the more recent Covid-19 pandemic and the financial markets instability they caused, the Fed instituted QE, a new, unconventional monetary policy program. The large-scale purchases of securities, including US Treasuries, corporate bonds, and even stocks and ETFs, in the open market by the Fed encouraged lending and investment and decreased interest rates. The purchases are meaningful – the Fed is currently buying $120bn in securities a month, and as a result the Fed has an unprecedented $8 trillion on its balance sheet.

“Tapering” refers to a reduction in the pace at which the Fed is buying these assets. Ultimately, the Fed will let the securities it purchased mature without replacing them. The Fed has indicated that it will taper before it will increase the target Fed Funds rate.

Taper Tantrum of 2013: After the Global Financial Crisis, the Fed purchased significant of securities via the first ever QE programs. In 2013, then-FOMC Chairman Ben Bernanke indicated that the Fed would begin to taper, surprising the market and causing US Treasury yields to rise rapidly, disrupting fixed income and currency markets in the US and overseas and causing a stock market sell-off. This event was called the “taper tantrum”. The Fed appears to have learned from its mistakes, and has been carefully signaling to the market that tapering would begin as early as this fall. Key announcements are expected over the next few months.

Impact on Investors: Over time, the Fed will reduce the emergency monetary policy support measures it put in place beginning in early 2020 to help the US economy stabilize and recover from the financial crisis caused by the Covid-19 pandemic. This is normal and a positive sign, as the US economy has strengthened considerably and growth is better than previously anticipated. The goal is to have a balance of a strong, growing economy, full employment, and moderate interest rates. Currently, market expectations are for tapering throughout 2022 and a potential interest rate increase in 2023, essentially a slow, deliberate return to normal. An increase in interest rates overall would impact how much investors earn on bond investments, how much homebuyers pay for mortgages and how much companies and governments must pay on their debt.

The cliché “the only constant is change” has particular application to the financial markets. The causes of that change may vary, but the markets will continue to fluctuate over time. Understanding key drivers, including inflation, interest rates, and Fed policy, is particularly helpful when navigating through volatility and investing for the long-term.

Less Quantitative Easing is Called “Tapering” – Slowly Taking Away the Punch Bowl: In response to both the Global Financial Crisis and the more recent Covid-19 pandemic and the financial markets instability they caused, the Fed instituted QE, a new, unconventional monetary policy program. The large-scale purchases of securities, including US Treasuries, corporate bonds, and even stocks and ETFs, in the open market by the Fed encouraged lending and investment and decreased interest rates. The purchases are meaningful – the Fed is currently buying $120bn in securities a month, and as a result the Fed has an unprecedented $8 trn on its balance sheet.

“Tapering” refers to a reduction in the pace at which the Fed is buying these assets. Ultimately, the Fed will let the securities it purchased mature without replacing them. The Fed has indicated that it will taper before it will increase the target Fed Funds rate.

Taper Tantrum of 2013: After the Global Financial Crisis, the Fed purchased significant of securities via the first ever QE programs. In 2013, then-FOMC Chairman Ben Bernanke indicated that the Fed would begin to taper, surprising the market and causing US Treasury yields to rise rapidly, disrupting fixed income and currency markets in the US and overseas and causing a stock market sell-off. This event was called the “taper tantrum”. The Fed appears to have learned from its mistakes, and has been carefully signaling to the market that tapering would begin as early as this fall. Key announcements are expected over the next few months.

Impact on Investors: Over time, the Fed will reduce the emergency monetary policy support measures it put in place beginning in early 2020 to help the US economy stabilize and recover from the financial crisis caused by the Covid-19 pandemic. This is normal and a positive sign, as the US economy has strengthened considerably and growth is better than previously anticipated. The goal is to have a balance of a strong, growing economy, full employment, and moderate interest rates. Currently, market expectations are for tapering throughout 2022 and a potential interest rate increase in 2023, essentially a slow, deliberate return to normal. An increase in interest rates overall would impact how much investors earn on bond investments, how much homebuyers pay for mortgages and how much companies and governments must pay on their debt.

The cliché “the only constant is change” has particular application to the financial markets. The causes of that change may vary, but the markets will continue to fluctuate over time. Understanding key drivers, including inflation, interest rates, and Fed policy, is particularly helpful when navigating through volatility and investing for the long-term.

Disclosure: The information contained herein is based on sources that are believed to be reliable. Any statements nonfactual in nature herein constitute only current opinions or estimates, represent only the current judgment of the author, and are subject to change without notice.

[i] https://www.frbsf.org/education/teacher-resources/what-is-the-fed/history/

[ii] https://www.federalreserveeducation.org/about-the-fed/structure-and-functions/monetary-policy