The financial markets have rebounded thus far in 2023, erasing some of 2022’s losses. Through January 31, 2023, the S&P 500 Index has gained nearly 6%, the NASDAQ is up nearly 11% and the Dow Jones Industrial Average is up over 2%. The fixed income markets have improved as well, with the Bloomberg Barclays U.S. Aggregate Bond Index up nearly 3%[1]. However, while we have had a strong start this year, it’s important to be aware of a fierce debate raging below the surface between the Federal Reserve (the “Fed”) and market participants. On the one hand, the Fed has emphasized that it will do what it takes to rein in inflation, which remains at unsustainably high levels. This includes continuing to tighten monetary policy by raising interest rates and reducing the liquidity it has been supplying to the market. On the other side of the debate, market participants believe that the Fed will capitulate sooner, ultimately reversing course and easing monetary policy potentially as early as the fall. Optimism for a “soft landing”, wherein the U.S. economy avoids a recession despite tighter monetary policy, or “no landing”, with the economy growing, have also fueled strong financial markets this year.

As a reminder, the primary risk of tightening monetary policy and rate hikes is a recession, i.e., a “hard landing”. With monetary policy tools, the Fed is actively trying to slow down the economy to get inflation under control. Higher unemployment and weak labor markets are typical. Currently, the Fed is trying to bring down high inflation without doing real damage to the economy but has said that it will risk a recession to bring inflation under control. A “soft landing”, in which the US economy avoids a recession and inflation comes back down is, of course, a much better outcome. Even more optimistically, economists have recently raised the possibility of “no landing”, given continued strength in the labor market and consumption. In a “no landing” scenario, the economy could grow despite the more restrictive monetary policy environment[2].

To be clear, what the Fed is attempting to do is hard. They are attempting to engineer a landing that is as ”soft” as possible despite hiking interest rates faster than at any time in recent history[3]. The risk of recession is high. This challenge is akin to landing an Airbus A320 on the Hudson River, as U.S. Airways Captain Chesley Sullenberger did in 2009. Adding to the difficulty are the facts that the Fed has imprecise tools at its disposal to fight inflation, namely, adding or subtracting liquidity to the U.S. economy via monetary policy programs and the Fed Funds rate. It is easy to overshoot and raise rates too high, causing a more severe recession than necessary.

Adding to the challenge, these imprecise tools have a lag effect. While some markets, like the housing and lending markets, react quickly to changing in interest rates and monetary policy, other markets, like the labor market, take more time. Consumer sentiment and spending are difficult to direct and control, as is corporate investment and spending. Creating more complexity, today’s inflation has been driven in part by transitory factors, including Covid-19-related impacts on labor markets and global supply chains, and the impact on global commodity prices due to the Ukrainian invasion in February 2022.

As I’ve noted in previous newsletters, there are a wide variety of outcomes from here. If the Fed is successful in engineering a soft or no landing, markets will likely continue to be strong. We may also have a hard landing, which we would know by the second half of 2023 or into 2024. This is a more dire scenario, with the potential for contracting economic growth, weak employment markets, weak housing markets and lower consumer spending. Given this range of outcomes, a diversified portfolio which balances both growth and defensive securities is most appropriate.

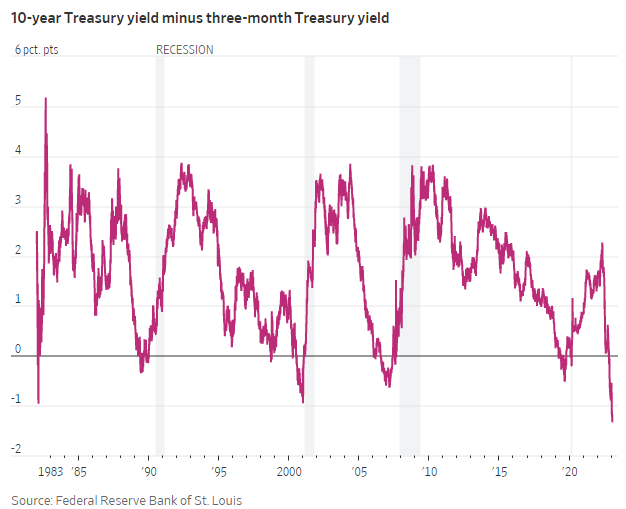

A key item to note is that the U.S. Treasury yield curve, a graph of the yield to maturity of U.S. Treasury securities from shortest maturity to longest, inverted in 2022 and remains so in 2023. An inverted yield curve is when short-term rates are higher than longer-term rates. In normal times, investors demand more return to hold longer-dated securities, and the yield curve is upward-sloping. When a yield curve inverts, investors expect growth to slow. Yield curve inversion often (but not always) indicates that a recession is coming. Inversions don’t typically persist, as they undermine normal financial system functioning and price signaling.

Market commentary over the past several months has been dominated by macroeconomic discussions and monetary policy, as the Fed is in the midst of unwinding the significant stimulus added to the markets after the Global Financial Crisis and the Covid-19 crash in March 2020. The stimulus was in place for so long that it became what many market participants assumed was normal. Risk assets across the board levitated for over a decade, and low lending rates fueled booms in public and private equity, credit and real estate. As that support is withdrawn, valuations will continue to be volatile and normalize. High volatility remains likely. We continue to focus on company fundamentals, including profit growth, free cash flow generation, balance sheet safety and returns on invested capital, and track secular trends that will persist despite the macroeconomic environment. For now, and over the course of the next several months, keep your helmets on. Hope is not something to ever invest based upon, as investing should be based on future cash flow expectations, but in this case let’s do hope that the Fed pulls off its “Sully” landing.

[1] S&P Capital IQ Pro

[2] https://www.wsj.com/articles/hard-or-soft-landing-some-economists-see-neither-if-growth-accelerates-854846ea

[3] https://www.weforum.org/agenda/2022/10/comparing-the-speed-of-u-s-interest-rate-hikes-1988-2022/

—

This communication is for informational purposes only. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Views expressed are as of the date published or sent, based on the information available at that time, and may change based on market or other conditions. Indexes are not illustrative of any particular investment, and it is not possible to invest directly in an index.